Britain agrees deals on clean energy, critical minerals with Zambia

LONDON, Aug 3 (Reuters) - Britain on Thursday said it had agreed deals with Zambia on clean energy and critical minerals as foreign minister James Cleverly ends a four-day visit to Africa to deepen ties.

Cleverly has used the trip, which fell shortly after a coup in Niger, to seek to enhance Britain's sway in Africa, welcoming regional talks on the Niger crisis and announcing support for Nigeria's agriculture sector.

The foreign ministry said Cleverly would agree a UK-Zambia Green Growth Compact, aimed at generating 2.5 billion pounds ($3.17 billion) of British private sector investment in Zambia's mining, minerals and renewable energy sectors alongside 500 million pounds of government-backed investments.

"The UK-Zambia Green Growth Compact and our landmark agreement on critical minerals will support investment between UK and Zambian business, creating jobs in both countries," Cleverly said.

Zambia is a major copper producer, and also has deposits of critical minerals such as cobalt, manganese and nickel. Last year Britain emphasised the importance of diversifying its supply chains in a critical mineral strategy.

Cleverly will visit a copper mine in Zambia and sign a memorandum of understanding (MoU) on critical minerals, which Britain said would "lay the foundation for further UK support for the responsible mining of copper, cobalt and other metals essential to the global clean energy transition."

Britain has agreed to deepen collaboration on critical minerals with other countries such as the United States, Japan, Australia, Kazakhstan and Saudi Arabia.

This article originally appeared on Reuters

Barrick’s Lumwana copper mine in Zambia gearing up for the future

Barrick’s drive to transform the Lumwana copper mine in Zambia into a Tier One asset with a life extending beyond 2060 is picking up speed with a strong performance in the past quarter adding impetus to its continuing production ramp-up.

Briefing media at a site visit here on July 7, Barrick President and Chief Executive Mark Bristow said the mine’s full potential was only now being revealed. Additional expansion opportunities, identified through an updated geological model, are currently being assessed, while drilling at the Kababisa prospect highlights potential mining flexibility through higher grades. The Lumwana pre-feasibility study is progressing in line with its plans to transform its long-term copper profile through the delivery of the envisioned super pit.

“Since Barrick refocused its strategy in Africa in 2019, Lumwana has become a key element in the expansion of our strategic copper portfolio and a significant contributor to our bottom line. At the same time its importance to Zambia has grown. Since 2019 it has contributed more than $2.3 billion to the country’s economy in the form of royalties, taxes, salaries and purchases from local suppliers,” he said.

Barrick has a global policy of sourcing its suppliers locally and last year it spent $432 million, 83% of its total procurement, with Zambian suppliers and contractors. It has also launched a ‘Business Accelerator Program’ to build the capacity of Zambian contractors in the mining supply chain.

Similarly, Barrick is committed to local employment. Currently 99.3% of Lumwana’s employees and 98% of its contractors are Zambian nationals, both industry-leading statistics. Lumwana is a participant in the United Nations’ REDD+ project, which is designed to reduce greenhouse gas emissions from deforestation, and the mine has engaged with its communities on this initiative.

Looking at the mine itself, in the presentation accompanying the announcement, Barrick said that Lumwana is on track to achieve 2023 production guidance as the operation ramps up after the wet season, reopens the Malundwe pit, and smoothly transitions to owner miner operations. There is also a plan to to transition away from contract mining in 2023 – with an investment of US$115 million being allocated to implementation of an owner miner waste stripping fleet.

Barrick recently stated: “During the fourth quarter of 2022, we began a transition to an owner miner fleet at Lumwana following a study which concluded that this option could result in a 20% cost reduction within the first five years versus contracted services. Separately, an owner miner strategy positions the operation well for future potential expansions including the Super Pit, which has the potential to extend Lumwana’s life into the 2060s.”

From the processing side, there has been a continuous improvement of processing stability leading to higher throughput and the mine is working to exceed the new base set as it moves into the second half of 2023. Recovery has also stabilised following the higher blend of fresh ore from the pit as mining ramps up. Significant investment has been made over the last few years in the new fleet leading to continuous improvement in availabilities, with the latest batch coming into production in April 2023. A new stripping fleet started arriving in Q2, which will continue throughout the year and is expected to see the stripping increase with the fleet arrivals.

Mining originally began at the Malundwe pit in 2008 by Equinox Minerals (Barrick acquired Equinox in 2011), and the operation ran successfully for some years as a trolley assist mine, with trucks going up ramp to feed a primary gyratory, then the ore utilising a 4.5 km conveyor to the plant. The lower grade Chimiwungo or ‘Chimi’ pit (in fact now three separate South, Main and East pits) some 7 km away was then developed starting with South in 2012 and a new primary gyratory crusher and its own 3.5 km conveyor built to allow the Chimi pit to feed the existing plant. Malundwe and Chimi both operated for some years – Malundwe was higher grade but the initial pit closed due to being mined out leaving only the Chimi operation. Malundwe is now set to be reopened and expanded.

Planned Lubwe starter pits to the north could potentially provide a high-grade, low strip ratio plant feed further enabling the unlocking of the value within the envisaged Chimiwungo Super Pit and the potential 40-60 year mine life. Two other prospects – Kamaranda and Kababisa have potential as additional satellites. The Super Pit PFS began in Q4 2022.

The mine initially operated with a fleet of 31 Hitachi 254 t class EH4500 trucks and five 27 m3 EX5500 shovels – four of them face shovels and one backhoe. Trolley assist was discontinued after mining moved from Malundwe pit. Barrick told IM that the main ramp to Malundwe is equipped with the trolley lines which are still in place however the pantographs were removed from the EH4500 trucks as they are now operating under full diesel power.

The current EH4500 trucks are reaching end of life and a competitive fleet replacement tender was held in 2021 where the Komatsu 290 t class 930E-5 was selected as the main new fleet truck type, with the EH4500s gradually being phased out. There are 15 of there running currently – the final new fleet will be a combination of 930E-5 and Hitachi EH5000 trucks – 30 in total. Four of the EX5500 shovels have been retired and one remains. The mine now operates three Komatsu PC8000 and three PC7000 shovels.

With emissions targets set by Barrick just as other top tier miners, IM asked if there was any plan to look again at running a trolley line: “In line with our commitment to reduce green house gas emissions we are in close discussions with our technology partners and OEMs on how to substitute fossil fuel with renewables. The feasibility of trolley assist is under investigation and consideration to ramp design is part of the expansion PFS that is underway.”

Aside from adding new equipment, Barrick added that its people are its greatest assets and training and upskilling is of cardinal importance. “This process starts with modern simulators we acquired to ensure that we can pick those with the best potential and continuously hone their skills to ensure they get the best out of our new assets. We have also reviewed our maintenance practices in close collaboration with our OEMs and sister operations in NGM to learn from past experiences.”

This article originally appeared on International Mining.

Great Future Beckons for Lumwana as Barrick Unlocks Potential

Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) – Barrick’s drive to transform the Lumwana copper mine into a Tier One asset with a life extending beyond 2060 is picking up speed with a strong performance in the past quarter adding impetus to its continuing production ramp-up.

Briefing media at a site visit here today, Barrick president and chief executive Mark Bristow said the mine’s full potential was only now being revealed. Additional expansion opportunities, identified through an updated geological model, are currently being assessed, while drilling at the Kababisa prospect highlights potential mining flexibility through higher grades. The Lumwana pre-feasibility study is progressing in line with our plans to transform its long-term copper profile through the delivery of the envisioned super pit.

“Since Barrick refocused its strategy in Africa in 2019, Lumwana has become a key element in the expansion of our strategic copper portfolio and a significant contributor to our bottom line. At the same time its importance to Zambia has grown. Since 2019 it has contributed more than $2.3 billion to the country’s economy in the form of royalties, taxes, salaries and purchases from local suppliers,” he said.

Barrick has a global policy of sourcing its suppliers locally and last year it spent $432 million, 83% of its total procurement, with Zambian suppliers and contractors. It has also launched a “Business Accelerator Program” to build the capacity of Zambian contractors in the mining supply chain.

Similarly, Barrick is committed to local employment. Currently 99.3% of Lumwana’s employees and 98% of its contractors are Zambian nationals, both industry-leading statistics.

Lumwana is a participant in the United Nations’ REDD+ project, which is designed to reduce greenhouse gas emissions from deforestation, and the mine has engaged with its communities on this initiative.

Zambia Debt Restructuring: What You Need To Know

On 22 June, Zambia announced that it had reached an agreement on comprehensive debt treatment according to the G20 Common Framework, just over 30 months after first defaulting on its debt. But what are the terms of the new debt arrangement?

How Much Does Zambia Owe?

Major bilateral creditors, including France and China, have agreed to restructure loans totalling to $6.3 billion.

Among the deals’ clauses was an obligation for “comparability of treatment for Zambia’s commercial debts”, guaranteeing that the $6.8 billion owed to private sector creditors would also be restructured according to the G20 Common Framework.

In total, $13.1 billion will be restructured under the deal.

How Will These Be Paid Off?

Zambia’s debts have been reorganised to be paid over a 20-year period with a three-year grace period. Zambia will only have to pay the interest rate on its loans until 2026, and will have until 2043 to conclude debt repayment, an extension of the previous deadline by 12 years.

Zambia’s rate of interest will be capped at 1% until 2037, and will rise to a maximum of 2.5% for the remainder of the loan. Zambia has been paying an average of 3.9% on its Chinese bilateral loans. Interest rates may rise to a cap of 4% if Zambia is upgraded from a low to medium debt carrying capacity.

Also included in the restructuring is a loan to cover the ongoing construction of the Kafue Gorge Lower hydroelectric powerplant.

What Does This Mean For Zambia

The deal also means that Zambia has fulfilled the requirements for the IMF to disburse its second instalment of $188 million agreed in April, which will be injected directly into the Zambian economy.

When President Hichilema returned to Lusaka’s Kenneth Kaunda International Airport, he said that the deal created the conditions necessary for Zambia to “rebuild confidence in our economy, attract foreign investment, and unlock the potential of our natural resources”.

Analysts expect Zambia’s bondholders to also strike a debt restructuring deal with the government in the coming weeks. This would secure a plan to pay back some $3 billion owed to private lenders. Optimism is particularly high after the bilateral debt deal saw the Zambian government pledge to speed up its repayments as the economy improves.

Debt Restructuring Deal Puts Zambia Back in the Champions League

After months of build-up and years of waiting, Zambia has arranged a historic deal to restructure more than $6 billion in debts owed to foreign creditors.

The deal, which will rearrange the structure of the money lent bilaterally to Zambia by nations including China, marks the first major debt relief assigned to a developing country within the Group of 20 (G20)’s Common Framework. Public sector creditors have agreed to reschedule $6.3 billion of debt, $.1.3 billion of which were accrued arrears.

The news was announced by a French official, and later confirmed by Zambia’s finance ministry, ahead of the Globate Climate Finance conference being held in Paris. The summit’s aims include combatting poverty, fighting climate change and reaching “climate solidarity” between developed and developing nations. The same official disclosed that the Memorandum of Understanding contains a clause “requiring comparability of treatment for Zambia’s commercial debts”, guaranteeing that private sector creditors will follow the G20 Common Framework and restructure the $6.8 billion they are owed, meaning that a total of $13.1 billion in debt is to be repackaged.

Presidents Macron and Hichilema greet each other outside the conference. (Hakainde Hichilema / Facebook)

Details are expected to emerge in the coming days once Zambia has formally accepted the debt relief, but an anonymous member of the Paris Club confirmed that China and India had agreed to terms with traditional creditor nations of the Club. It is further understood that the creditors have unilaterally agreed to extend the repayment deadlines for loans by 20 years, with an initial three-year grace period also among the terms.

The memorandum that will be signed will be historic for a number of reasons. The relief will address the debt Zambia incurred when it became the first African nation to default on COVID pandemic-era national debt; the arrangement is the first significant restructuring agreed within the G20 Common Framework; and the deal is likely to lead the way for other struggling nations, including Ghana, Sri Lanka and Ethiopia, whose talks with major creditors have all recently stalled in similar fashion to those of Zambia in the spring.

Janet Yellen, the U.S. Treasury Secretary, mentioned that debt relief was an urgent priority for Ghana and Sri Lanka upon arriving in Paris on Wednesday, when she hinted at Zambia’s debt deal being “very close”. Yellen has been a central figure in the revitalisation of multinational discussions on Zambian debt resolution, and drew attention to the urgent need for round-table talks during her visit to the nation as part of her January 2023 tour of Africa.

Secretary Yellen with President Hichilema during her tour of Africa in January 2023 (Saul Leob / Getty Images)

The deal has yet to be signed; its announcement, nonetheless, has had an immediate and profound impact. Zambia’s currency has rallied 12% this month, making the kwacha the fastest-growing of the 150 currencies monitored by Bloomberg. The 12% increase is the greatest growth the kwacha has enjoyed in more than 7 years. Zambia’s eurobonds, meanwhile, have returned 10.1%, a figure bested only by El Salvador and Argentina.

In October, Zambia’s treasury secretary, Felix Nkulukusa, said that the country was seeking to restructure 12.8 billion in external debt. Nkulukusa also explained that reducing foreign holdings of domestic debt would release funds for other creditors such as China. It is suspected that a significant portion of this initial $6.3 billion package will be committed to servicing debt holdings.

The Paris Club official also disclosed that the $4.1 billion owed to the national Export-Import Bank of China formed the majority of the $6.3 billion package, which is publicly known to have been funds owed to government bodies. They added that Beijing was wary to be seen holding up debt relief for Zambia at a summit attended by 40 world leaders designed to ease debt burdens for developing nations and free up finances for climate initiatives. President Macron’s meetings with Chinese authorities in Beijing in April are understood to have had a significant impact on yesterday’s final talks.

Presidents Macron and Xi in April. (Eliot Blondet / Sipa USA)

Eswar Prasad, professor of economics at Cornell University, said that China’s “endgame seems to be a resolution that limits its financial losses while spreading more broadly the blame for the distressing and untenable situation that many highly indebted economies find themselves in”. The International Monetary Fund has estimated that 70 of the lowest-income nations are burdened by a collective $326 billion in debt; more than half of those same nations are in, or reaching, debt distress.

Ghana and Ethiopia have been locked in talks with creditors for months, their debts dominated by loans from China. It is hoped a solution to their plight will be agreed by the conference’s conclusion.

The scale of Zambia’s debt had been a cause of concern for major Zambian creditors and potential investors, compounding its repercussions. Financing assurances were provided by Zambia’s biggest creditors in July 2022; reports in January 2023 expected restructuring to take place in March. In May, two months after debt relief was supposed to have been arranged, Zambia’s central bank was forced to raise inflation by 25 basis points to 9.5%. Growth in 2022 reached 4.7%, despite Zambia’s distressed status, but forecasts expected a drop to 3.6% in 2023. The IMF guaranteed a $188 million financing disbursement in April 2023, to be released once debt was restructured; Zambia has been waiting patiently for this immediate boost to their economy ever since.

Finance Minister Musokotwane during July 2022 negotiations. (Zinyange Auntony / Getty Images).

Kristalina Georgieva, managing director of the IMF and another vocal supporter of Zambia, issued a statement on Thursday, which read, “Today we will talk about Zambia, which I think is a great case of celebration because it makes debt restructuring agile and effective”. Visiting Lusaka in January 2023, Georgieva committed to assisting “Zambia on its journey towards a more resilient and inclusive future”. She said that she was “hugely impressed by Zambia’s enormous potential given its rich endowment of natural resources, and a dynamic and entrepreneurial youth population”. She praised Zambia’s “efforts to improve the use of public resources by reallocating resources from poorly targeted and inefficient spending and redirecting them to much-needed spending on education and health”, and asked creditors for “swift resolution of its debt situation to complement these reform efforts and preserve the positive growth momentum”.

In April, Georgieva accompanied a trip of IMF staff to Zambia, and told reporters that “The ball is truly in the court of the creditors”. Georgieva and the IMF’s unrelenting support for Zambia has been critical in adding much-needed optimism to the discussion of Zambia’s debt relief and highlighting the role that China and private creditors could play in Zambia’s return to economic good health.

IMF Managing Director Georgieva in Chongwe, Zambia. (Kim Haughton / IMF)

This morning, Hakainde Hichilema, President of Zambia, spoke before delegates at the New Global Financing Pact at Palais Brongniart, Paris. He thanked Presidents Macron and Xi, along with other major creditors. Hichilema concluded his speech with a familiar refrain: “Zambia is back in the Champions League”.

The World Is Coming To Zambia

By Albert Halwampa, Director General of the Zambia Development Agency

May has been a milestone month for the Zambia Development Agency.

On May 1, President Hakainde Hichilema officiated at the ground-breaking ceremony for the construction of the United Capital fertiliser plant, a project worth $600 million that was facilitated by the Zambia Development Agency (ZDA). Fittingly, the ceremony took place on International Labour Day. The urea and ammonium plant is just the latest in a series of high-value infrastructure investment partnerships specifically designed to boost the Zambian economy whilst guaranteeing long-term sector sustainability, infrastructural enrichment and stable local employment.

The signing of a memorandum of understanding between the ZDA and Invest Africa on the sidelines of the Africa Debate in London.

On May 4, as Director General of the ZDA, I was delighted to announce a record high projected investment for Q1 of 2023, with investment ventures worth $8.57 billion secured. This represents a nearly 3,500% increase compared to the same period last year. All in all, 81 investment ventures were undertaken in Q1 of 2023, compared to 74 in Q1 of 2022. Not only, therefore, have the overall volume of investments grown but the average financial commitment of each investment has also reached new heights.

As a direct result of these investments, 13,435 new jobs will be sustained. Furthermore, the $8 billion worth of investments earmarked for the energy sector will help fulfil our commitment to Zambia’s energy security and empower Zambians to fulfil their potential in every segment of the economy.

In line with the New Dawn government’s pledge to make Zambia a regional and continental economic powerhouse, we were also pleased to announce that the ZDA has facilitated market access for 20 exporters to potential buyers, and has audited 101 exporters in the Copperbelt, Lusaka and Eastern Provinces.

Further afield, this month I had the pleasure of attending the Africa Debate at the Guildhall in London. With me, alongside a number of other Zambian businesspeople and ministers, was President Hichilema, who in his keynote speech reminded investors that Zambia is “looking for mutually beneficial partnerships”.

President Hichilema at the Zambia Investment Forum, hosted by Invest Africa.

This conference was not only a chance to showcase how far Zambia has come but also an opportunity to further advance our fortunes as a nation. Meetings at the side-lines of the Africa Debate and the Invest Africa Zambia Investment Forum have so far yielded deals with some 162 companies, including a memorandum of understanding with Invest Africa itself to promote foreign direct investment from the UK into Zambia.

I was proud to sign this MoU myself, together with IA chairman and former Africa Minister the Rt Hon. Mark Simmonds. The agreement is yet another indicator of the strong bonds between the ZDA and Invest Africa, as well as Zambia’s longstanding partnership with the UK, and I look forward to welcoming the businesses and financiers that come to Zambia as a result of this close cooperation.

Also agreed within the MoU were provisions to mobilise investments from Europe, the United States of America, the Middle East and Africa, and to continue to hold promotional activities in Zambia and the UK on a reciprocal basis. The sectors likely to benefit the most from our continued partnership with Invest Africa are Agriculture, Energy, Mining and Tourism – all of which are critical to Zambian employment and localised economic enrichment.

Delegates at the business forum in Lusaka, co-hosted by the ZDA and Etion.

On May 18, the ZDA hosted a business forum in partnership with Etion, a business delegation from Belgium in Lusaka. A business-to-business (B2B) meeting was held, along with a networking session, to encourage business linkages and joint ventures between Zambian and Belgian enterprises. So many European investors are excited to deepen ties with Zambian business and industry and I have no doubt that investment summits such as this will continue to enjoy enormous success.

It is a very exciting time to be at the helm of the ZDA, a fantastic moment to be investing in our country, and a proud moment to be Zambian. We look forward to the results of Q2, continue to plan more investment summits, and eagerly anticipate forging new business ties and solidifying those we have already established.

Zambia is Ready for Business, Assures President Hichilema

Last week was a busy week for Zambia’s President Hakainde Hichilema and one that is already being considered a significant milestone in the country’s return to economic stability and prosperity. The President accepted an invitation to attend the coronation of King Charles III on Saturday 6th May and made the most of his trip by pursuing a week of business talks with delegates and investors across the UK and France.

President Hichilema announced on Friday evening that “After a week of over 20 successful meeting and engagements in England, Scotland and France, we have departed from London and are heading back home. We are positive that these engagements will yield positive growth and development for the Zambian people”.

President Hichilema, spotted at Heathrow airport on his way back to Lusaka.

On Tuesday, 9th May, President Hichilema met with the CEO of the UK government’s finance institution, British International Investment (BII), Nick O’Donohue. BII has to date invested more than $100 million in the Zambian economy, especially in the agricultural, energy and economic sectors. President Hichilema assured Mr O’Donohue that the BII’s “investments are safe”, and that Zambia was “looking for mutually beneficial partnerships based on common values and interests for the people of Zambia and the UK”.

On Wednesday, 10th May, President Hichilema held a meeting with Scotland’s First Minister, Humza Yousaf, to strengthen bilateral ties between the nations; HH was delighted to announce that Scotland had committed £1 million to the construction and maintenance of an academic economic research facility in Zambia.

That afternoon, Mr. Hichilema met with Emmanuel Macron, President of France, who sits on the board of the Paris Club of Creditors and the G20 intergovernmental forum. Also present at the meeting were Zambia’s Ministers of Foreign Affairs and International Cooperation, Stanley Kakubo, and of Finance and National Planning, Situmbeko Musokotwane, and some have speculated that some significant trade agreements were tabled at the meeting. All President Hichilema was willing to tell the press was that state debt relief and investment were discussed, and that the meeting was successful.

Presidents Macron and Hichilema before their meeting.

After a number of days of meeting with world leaders, CEOs of global financial institutions and economic experts, President Hichilema headed to the Zambia Investor Forum and Africa Debate in London on Wednesday and Thursday, both organised by Invest Africa, to speak with prospective investors. Mr Hichilema began his keynote speech on Wednesday by reiterating that his government was “committed to reforms – after all, we were elected on a ticket of change, to improve the lives and livelihoods of our people […] through the economy”.

President Hichilema delivering his keynote speech.

President Hichilema said that his government would pursue private sector partnerships to improve the economy and, therefore, the wellbeing of Zambia and its people. He said that the New Dawn government had shown “clear intent” in its meetings with the International Monetary Fund, a major U.S. financial agency and institution which has been pushing for creditors to agree to a framework for Zambia’s debt relief.

Finance Minister Situmbeko Musokotwane urged major investors and economic gurus present at the event to “push for this debt relief to take place”, as Zambia had met all requirements set out in the framework submitted by creditors. Zambian and Western financial figures alike have been frustrated by an apparent reluctance from Chinese creditors to agree to debt relief, though the state visit of President Hichilema and Ministers Musokotwane and Kukubo may prove to be what is needed to move talks forward.

Commerce, Trade and Industry Minister Mulenga announced that the government had set aside 800,000 hectares of land for agricultural development. Zambia enjoyed a record maize harvest last year and will be hoping to shatter that record after receiving assistance from a multi-partner group led by USAID (the United States Agency for International Development) that has put in place the necessary infrastructure to fight against transport issues that have historically contributed to 30% of Zambia’s post-harvest losses. Seven Smart Integrated District Aggregation Centres (SIDAC) have been built to process and store 100,000 metric tons of maize and other grains that would otherwise go to waste. National and international initiatives have also successfully raised awareness about crop diversity in the country, ensuring agricultural stability, sustainability and soil re-enrichment.

Minister Mulenga at the Zambia Investment Forum.

Foreign Affairs Minister Kakubo also reminded investors that Zambia’s vast quantities of minerals “are in the ground, and most of them are not yet explored”. The exploration that has been done shows that Zambia has 6% of the world’s copper reserves and huge deposits of cobalt: two metals that will continue to grow in value as the world transitions to green energy and electrically-powered vehicles.

Zambia is also known for its rich deposits of gold, iron, nickel, manganese and emeralds. The country is the world’s seventh-largest producer of copper, the sixth-largest producer of cobalt, and boasts the largest emerald ever mined. The New Dawn government has recognised the potential for its mineral reserves to transform the nation’s fortunes, making mining one of the primary sectors driving economic growth and benefitting people across the country. Kakubo stressed that he and other senior figures in the mining industry were looking for partnerships to aid exploration into mineral deposits and expansion of the country’s mines. In May 2022, First Quantum Minerals approved plans for a $1.25 billion expansion of the Kansanshi copper mine after “renewed confidence” in Zambia’s economic climate, and other major deals have followed since.

On Thursday, President Hichilema attended Invest Africa’s Africa Debate, an investment summit focused on the African continent whose themes included “the future of African trade, discussing and debating the continent’s trade profile”. Mr. Hichilema gave a keynote speech alongside Andrew Mitchell, the UK Minister of State in the Foreign, Commonwealth & Development Office (FCDO). With a touch of humour, Mr. Hichilema spoke of the importance of education, saying that without the education he had received, instead of being President of Zambia he would “be in the village with 8 or 10 wives”. He reminded the audience that waning diplomacy, the decline of democracy and insufficient protection of human rights were not good for business, highlighting the importance of “peace, security, stability”. He said it was the responsibility of those in power to create a landscape that invited investment and economic growth.

President Hichilema deep in conversation at the Africa Debate.

Karen Taylor, CEO of Invest Africa, who hosted the Investor Forum event, said that “since President Hichilema took office in August ’21, Zambia has undergone a significant shift, change and focus in its economic policies and its approach”. She said that Invest Africa would continue to market Zambia as an investment destination, and that the steps taken by the government had been a significant factor in many organisations’ decision to invest in Zambia. Ms. Taylor applauded the economic reforms the UPND government had made, insisting that this had created an “enabling environment” for foreign direct investment. Mr. Hichilema said after the event that he was “humbled by the huge interest” in Zambia’s economy, and the attendance of “hundreds of key business players from various economic sectors”.

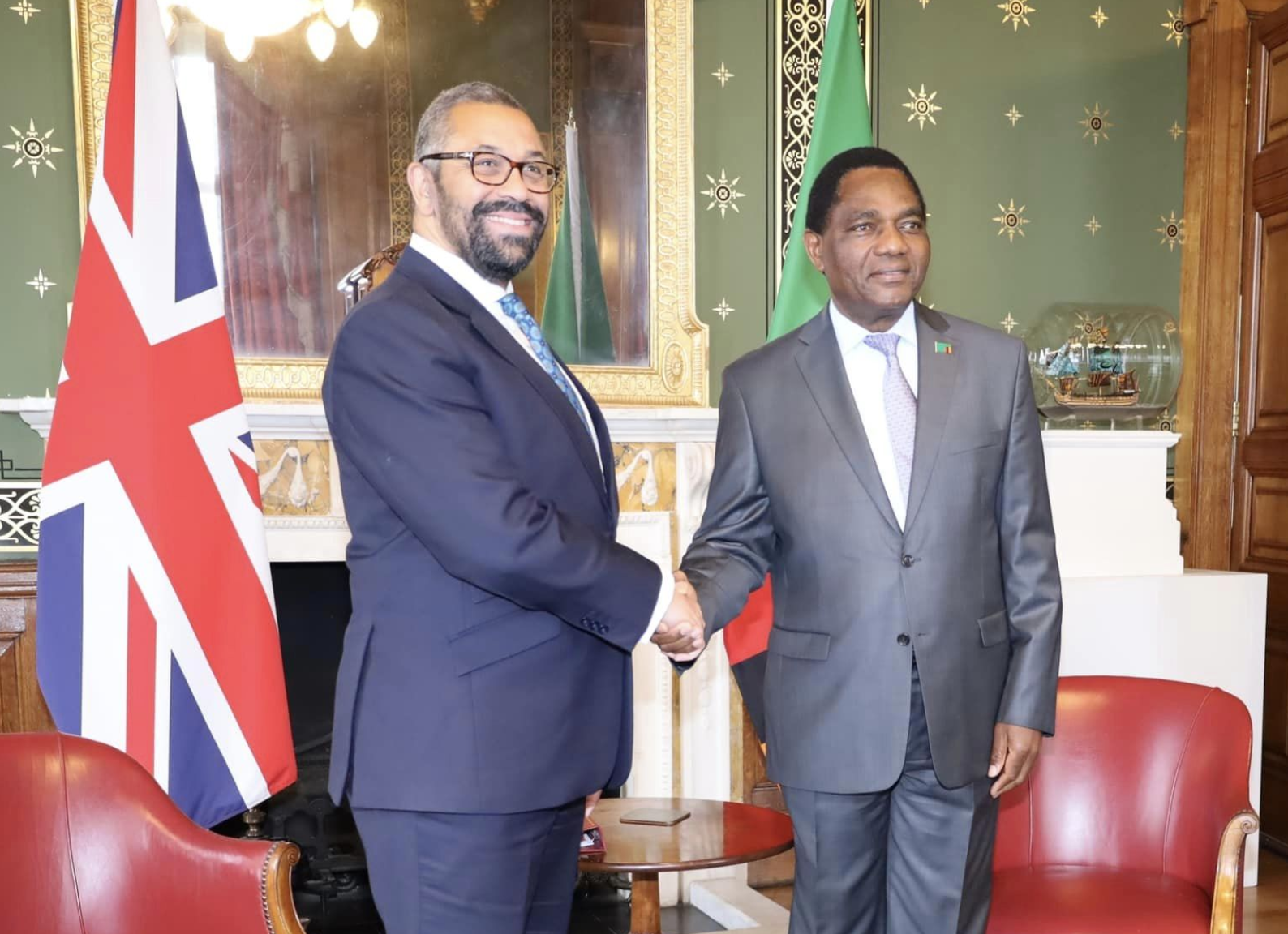

During the Zambia Investor Forum, Zambian Ministers “held a series of meeting with key players in the agriculture, tourism, mining, infrastructure, and energy sectors”, negotiating “investment in our country that will create opportunities and jobs for our citizens,” said Mr. Hichilema. After the event, Mr. Hichilema met with UK Foreign Secretary, James Cleverly, who “expressed how impressed the UK is with Zambia’s development trajectory”, and “reaffirmed the UK government’s support for Africa to have a bigger voice at the G20”. President Hichilema said the meeting was productive, and promised that the government would “continue to encourage joint ventures to ensure that these investments benefit as many of our people as possible”.

President Hichilema with Minister Cleverly at their meeting.

Zambia’s GDP to Grow by 4.2% in 2023

Secretary to the Treasury, Felix Nkulukusa, announced yesterday that Zambia’s economy is projected to expand by 4.2% in 2023.

This will be a slight dip compared to last year’s growth of 4.7%, which is to be expected following the months of wrangling over the country’s debt restructuring. However, the Secretary was optimistic about the news, as GDP forecasts 4.8% and 4.7% growth in 2024 and 2025 respectively.

This is very welcome news. Zambia was the first major country to default on its $18 billion foreign debt during the Covid pandemic in 2020. The following years has seen issues with its creditors, who had for some time struggled to make headway with debt restructuring plans.

Zambia’s external debt is split roughly three ways: one third is owed to Chinese lenders, another to private creditors, and the rest to other governments and multilateral lenders, such the World Bank and International Monetary Fund (IMF).

Nkulukusa said central government external debt had increased by 1% to $14.09 billion as of end of this March from $13.96 billion at the end of 2022, making Zambian public debt a total of $25.4 billion.

He said in his announcement, “the increase in debt stock was largely on account of disbursements received from multilateral creditors for budget support and project loans”.

Photo: @CUTS_Lusaka / Twitter

President Hichilema to Speak at The Africa Debate, London

President Hakainde Hichilema is due to deliver a speech at The Africa Debate, London’s leading investment summit focused on Africa. The event – this year being its ninth iteration – will be held on 11 May at the Guildhall under the theme “Catalysing the Continent’s Trade Potential”.

Attendees at this year’s Africa Debate will span continents and industries. Among the guest list are representatives of investment firms, heads of global businesses, and policy and change makers from across the globe, including Africa, Europe, North America, and the Middle East.

The President is set to be the focus of the “Country Spotlight” event, where he will be interviewed about Zambia’s growing trade potential. Other events in the programme include interviews with Wamkele Mene, Secretary General of the African Continental Free Trade Area, and Samaila Zubairu, President and CEO of the Africa Finance Corporation, as well as speeches from British politicians Mark Simmonds and Andrew Mitchell.

Delegates at The Africa Debate, 2022. Photo: Fiona Hanson

There will also be various debates held throughout the day. A panel will discuss “Building a Comprehensive Digital Trade Strategy for Africa”, which will explore innovation in digital strategy and e-commerce across the continent. Other topics set to be explored through debates and panel discussions include: boosting the industrialisation of African countries; ESG regulatory initiatives in African trade; leveraging the continent’s critical minerals supply; and strengthening Africa’s finance sector.

The Africa Debate is organised and hosted by Invest Africa, the UK’s leading trade and investment platform for African markets. Invest Africa describes the continent’s trade outlook as “at a crossroads”. On the one hand, it is suffering from global supply chain disruptions following the Covid pandemic and the Russian invasion of Ukraine which “paint[s] a gloomy picture” of the future of Africa’s trade, as well as the threat of debt risks. But on the other hand, African trade and investment is aligning under the recently established African Continental Free Trade Area (AfCFTA), which aims to strengthen and protect it.

It is hoped that The Africa Debate in May will provide a forum for leaders in industry to discuss, and prepare for, the future of African trade. There is still time to register for a place at the summit.

Zambia Airways Resumes Flights To Zimbabwe After 27 Years

Zambia Airways re-enters the regional network with three weekly flights to Harare after 27 years.

Zambia Airways (ZN) has resumed flights to Zimbabwe after 27 years. The airline was relaunched in December 2021 and has re-entered the regional network with a flight to Harare.

The inaugural flight took off on March 28 from Lusaka Kenneth Kaunda International Airport (LUN) and landed at Harare Robert Gabriel Mugabe International Airport (HRE), where a water cannon salute awaited. The flight was welcomed by government officials, news reporters, and various aviation, hospitality, and tourism stakeholders.

New regional route for the airline

Zambia Airways had been liquidated for more than 25 years but resumed operations on December 1, 2021, with the help of Ethiopian Airlines and the Zambian Industrial Development Corporation. Since then, it has been operating flights on domestic routes.

Last month, the Civil Aviation Authority of Zimbabwe (CAAZ) granted two Foreign Operator Permits (FOPs) to Eswatini Air and Zambia Airways. This gave ZN the green light to operate scheduled flights to Harare, which sees it re-enter the international network after nearly three decades.

The 55-minute flight to Harare was operated on a DHC-8-400, the only aircraft in the carrier's fleet. The airline will operate three weekly flights between Lusaka and Harare and plans to fly at least 1.9 million passengers annually by 2028.

Intra-Africa connectivity

Numerous stakeholders have been involved in the development of aviation in Africa. In line with the Single African Air Transport Market (SAATM) and the Open Skies Policy, Zambia Airways is spreading its wings and promoting intra-Africa connectivity.

As the industry has almost fully recovered from the pandemic, it is the perfect time for African airlines to step up and serve the continent. About 70% of African air travel is served by international airlines. The LUN-HRE has been dominated by Qatar Airways and Emirates, which operate five and seven weekly flights.

Launching the Zambia Airways flight can significantly boost trade, tourism, and business opportunities between the two neighboring countries. At an event following the airline's touchdown, Zimbabwe's Transport and Infrastructural Development Deputy Minister said to NewsDay: “Indeed, our two countries are Siamese twins who share a lot in common. Let us bear in mind that the opportunity offered by Zambia Airways creates copious room for scaling up our further co-operation in areas of aviation and deepening the people-to-people relations, as these are a catalyst for stronger relations between our two countries. To attain the desired middle-income status and fully modernize our countries, it is imperative that we develop reliable, adequate and appropriate aviation linkages.”

Zambia Airways expansion in the near future

The airline is delighted to have launched its first regional route since its restructuring. The route is expected to have a high demand; hence, the airline plans to launch a frequent flyer program in the near future. The program will be known as Zambezi Miles, allowing travelers to earn and spend rewards on Zambia Airways flights.

The Zambian government is eyeing a collaboration with other airlines operating the LUN-HRE route and fifth freedom flights to South Africa. Speaking at the welcoming event, acting Permanent Secretary for the Transport and Logistics Ministry of Zambia, Stephen Mbewe, said: “We are very grateful for our two airport cooperation, in the collaboration we have been doing for so many years, we've seen this during the time British Airways used to fly here, Kenya Airways, and now we see it with Qatar and Emirates. We hope the collaboration will go on with several other airlines, but we also have a plea honorable minister. We would like a fifth freedom to do the Lusaka-Harare-Johannesburg route.”

The two states are active members of the Southern African Development Community (SADC), founded in Lusaka, Zambia. SADC countries have substantial travel and trade partnerships, which the airline can leverage to enhance its regional connectivity.

This article was published by Simple Flying.

Invest Africa Concludes Successful Visit to Zambia

On Thursday, the Invest Africa group wrapped up its inaugural Investor & Trade Mission to Zambia: capping off three days of illuminating and exciting discussions between the government and business groups.

Highlights of the trip included a roundtable meeting with President Hakainde Hichilema at State House, as well as a discussion with Bank of Zambia Governor Denny Kalyalya, and a presentation on trade and investment opportunities by Zambia Development Agency (ZDA) Director Albert Halwampa.

Among the businesses represented at the mission were global law firm DLA Piper, German technology and industrials manufacturer Siemens, financial services firm Absa Group, and logistics giant DHL.

ZDA Director Albert Halwampa speaks with delegates from the Invest Africa Trade Mission.

The purpose of the visit was to promote and build connections for potential investment and trade opportunities for foreign companies in Zambia. It follows concerted efforts by the New Dawn government and national agencies to diversify Zambia’s economy and stimulate private sector growth.

Of particular note was a presentation by Technology and Science Minister Felix Mutati, which focused on how technology can help to drive forward Zambia’s economic transformation.

Hon. Mutati highlighted the importance of the digital economy in supporting Zambia’s strategic development objectives. As well as bolstering Zambian infrastructure, he pointed out that digital services such as e-trade and financial technology (FinTech) platforms could help businesses in Zambia to grow more quickly.

The minister highlighted emerging technologies such as Artificial Intelligence as being a real ‘game-changers’ in terms of value addition for businesses. However, he stressed that Zambian citizens were at the heart of the country’s digital transformation and that digital platforms will only succeed if Zambians can see the benefits in adopting them.

Zambia Is Back spokesperson Choolwe Chibomba (left) with Technology Minister Felix Mutati.

The presentation by ZDA Director Albert Halwampa, meanwhile, focused on active opportunities for trade and investment within Zambia. These included the Mulembo-Lelya Hydroelectric Project, which is looking to raise $285 million and will generate 118MW of electricity once completed. The project is currently accepting FDI proposals through either a majority or minority stake, as well as through a joint venture or public-private partnership.

Mr Halwampa also showcased an opportunity for investment at the Shangombo Sugar Project, which requires $522.3 million through a FDI majority stake. The project is located at a Greenfield site in Western Province.

Investors looking to hear more about these or any other opportunities can contact the Zambia Is Back campaign – part of the ZDA – at info@zambiaisback.com

Zambians say their country is a functioning democracy - Afrobarometer

Most Zambians surveyed by Afrobarometer see their country as a "full democracy".

The country has had six presidents following the fall in 1991 of founding president Kenneth Kaunda, who had ruled Zambia for 27 years.

Eight in 10 citizens (80%) consider Zambia “a full democracy” or “a democracy with minor problems”, according to the survey.

The survey also noted that 87% of Zambians in the survey prefer democracy to any other form of government.

Non-democratic alternatives such as one-party rule were also rejected by 87%, while 91% were against military rule and almost everyone surveyed (95%) were against a dictatorship.

Kaunda's reign was broken by Frederick Chiluba, effectively breaking the political dominance of the United National Independence Party (UNIP), which had operated a one-party state from 1973.

Chiluba, under the Movement for Multi-party Democracy (MMD) came in for two terms, followed by his successor Levy Mwanawasa.

Rupiah Banda took over from Mwanawasa, who died in office, but then lost to "The King Cobra" Michael Sata of the Patriotic Front (PF).

Sata also died in office and his deputy Guy Scott led the country for almost three months into the next elections, when Edgar Lungu stood and won as the PF's candidate.

But after one term, Lungu lost to the incumbent Hakainde Hichilema of the United Party for National Development.

A considerable number of Zambians interviewed by Afrobarometer said the country had greatly improved as a democracy.

"Half (50%) of Zambians believe that the country has become 'more democratic' over the past five years, while 21% think democracy has lost ground," the report said.

Hichilema beat Lungu by more than a million votes in what was his sixth attempt at the presidency.

Hichilema's victory was largely credited to the huge turnout by youthful voters.

Zambians believe their country will be a more improved democracy in the next general elections in 2026.

"Nearly six in 10 (57%) believe that in five years’ time, the country will be more democratic than it is today," the survey found.

A leader in democracy

Zambia has emerged as exemplary when it comes to the smooth transition of power in Southern Africa.

Next week the country will be one of the hosts of the Summit for Democracy.

Zambia will join the United States, Costa Rica, the Netherlands, and the Republic of Korea.

According to a statement issued by the US government, the summit will "highlight the many electoral stakeholders contributing to electoral integrity and explore how elections on the African continent have changed in recent years".

Some of the key engagements at the summit will be new approaches and partnerships that strengthen democracy, human rights, and governance.

President of Ukraine, Volodymyr Zelenskyy, will be given a virtual platform and is expected to discuss his vision for a just and lasting peace in Ukraine and rally Africa's support.

This article originally appeared in news24

PWC Delivers Positive Outlook for Zambian Economy

PwC Zambia has predicted a positive outlook for the future of the Zambian economy, highlighting encouraging trends in inward investment and an upcoming boon for the country’s agricultural sector.

Speaking during the firm’s Economic Review of 2022 on Wednesday, PwC’s senior country partner for Zambia Andrew Chibuye and Zanaco chief risk officer Mutisunge Zulu offered a balanced perspective on the challenges which the country has experienced over the last few years, whilst also showcasing the positive impact which the New Dawn government has had on the state of the country’s economy.

Under the previous Patriotic Front government, Zambia was the first COVID-era African nation to default on its debt-repayments, putting the country in a challenging position economically. Nonetheless, under the guidance of President Hichilema and the New Dawn government, economic prospects are improving, with finance Minister Situmbeko Musokotwane hoping for the debt restructuring process to be completed in the next few weeks. Speaking on this, PwC noted that a debt restructure deal is likely to bring about additional investment into the country as the economy continues to stabilise and grow.

Speaking on behalf of Zanaco, Mr Zulu also offered positive news for agriculture within the country. As the Russian war in Ukraine sadly continues, and agricultural exports from Ukraine become increasingly challenging to obtain on the global market, Zambia’s strong agricultural sector has an opportunity to benefit from the gap which the market currently experiences, Zulu highlighted.

The progress of inward invest within Zambia over the past few years painted a similarly pretty picture, with funding rising from just US$0.7 billion in 2018 to US$4.5 billion in 2022. With the exception of the pandemic year of 2020, Zambia is continuing to experience year-on-year growth in its internal investment.

Commenting on these figures, Mr Chibuye observed that “It’s a very positive story, activity is starting to happen and it is only a matter of time before the activity then starts to bear fruit in terms of jobs, more economic activity etc.”.

Around the world, investors are starting to look at Zambia with fresh eyes, with PwC’s positive assessment adding reassurance to those considering making investments within the country.

To watch to the full review, visit: https://fb.watch/jqH45MgU88/.

US Vice President Kamala Harris Visiting Zambia This Month

A White House official press release has announced that Zambia will be one of the nations that U.S. Vice President Kamala Harris and Second Gentleman Douglas Emhoff visit as part of their trip to Africa.

The White House announced that the visit “will build on the recent U.S.-Africa Leaders Summit” at Washington in December 2022, and aims to “strengthen the United States’ partnerships throughout Africa and advance our shared efforts on security and economic prosperity.”

Among the visit’s key goals will be to “expand access to the digital economy, support climate adaptation and resilience, and strengthen business ties and investment, including through innovation, entrepreneurship, and the economic empowerment of women”.

The press statement also confirmed that Vice President Harris will meet with Zambia President Hakainde Hichilema. The pair plan to discuss “regional and global priorities, including our shared commitment to democracy, inclusive and sustainable economic growth, food security, and the effects of Russia’s unprovoked war in Ukraine”.

Also scheduled are a number of meetings with “young leaders, business representatives, entrepreneurs, and members of the African Diaspora”.

The visit will begin on March 25 and end on April 2. Vice President Harris will visit Ghana, Tanzania, and then Zambia.

Invest Africa Leads Trade Mission To Zambia; Meeting With President Hichilema

On the back of past successful investor and trade missions to Tanzania, Ethiopia and Angola, Invest Africa are leading a delegation for an Investment and Trade Mission to Lusaka, Zambia from 20 to 23 March 2023.

The main objective of the Mission is to provide a platform for international and regional investors to meet and engage with senior Zambian government officials, as well as key Zambian investment and trade institutions including the Zambia Development Agency (ZDA) and the Public-Private Dialogue Forum. Meetings will also be held with private sector organisations to promote and build connections for potential investment and trade opportunities.

Invest Africa has assembled a comprehensive agenda to make the trip as valuable as possible. The delegation has been granted an audience with Zambian President, His Excellency Hakainde Hichilema, as well as meetings with with the Central Bank Reserve Governor, the Minister of Industry, Trade and Commerce, the Zambian Development Agency, and other ministries.

The delegation will look to gain more detailed insights into opportunities within Zambia’s key sectors, including agriculture and agribusiness; infrastructure development; mining and minerals; energy and renewables; and travel and tourism. The delegation will also learn about Zambia’s services sector – including ICT, legal and financial services – as well as manufacturing firms, such as engineering, textiles, building materials, food processing, chemicals, and pharmaceuticals.

Zambia’s business environment is going from strength to strength, as investors continue to express renewed confidence in the government’s business-friendly policy reforms. In 2022, the country received a record $8.59 billion in foreign investments and is set to become an even more attractive investment destination in 2023.

Invest Africa CEO, Karen Taylor said, “This Mission to Zambia comes at the right time as we see the government’s efforts to diversify the economy by stimulating private sector growth which is vital to sustained economic growth.”

There are limited spaces still available for international delegates to join this Mission and interested organisations can contact Mission organiser, Farha Musa at Invest Africa.

About Invest Africa

Invest Africa is Africa’s leading international business and investment development platform. With over sixty years of history, our network is made up of more than 400 global organisations, private investors, fund managers, family offices, policy makers and entrepreneurs. Together they share a desire to build opportunity across the African continent. As the trusted entry point into Africa, we support and connect business and investment through a unique range of services and events; from world-leading business conferences and bespoke trade and investment missions to sector specialist event programmes and consultancy projects. Our team comprises leading specialists in international trade and investment promotion, public affairs, conferences and events and business strategy.

Mission Contacts:

Farha Musa – farha.musa@investafrica.com Charlotte Kemp – charlotte.kemp@investafrica.com

Media Contacts:

Choolwe Chibomba – choolwe@zambiaisback.com

Zambia's mining minister expects Mopani Copper Mines deal by end-March

CAPE TOWN, Feb 6 (Reuters) - Mopani Copper Mines will secure a new investor by the end of this quarter, Zambia's mines minister Paul Kabuswe said on Monday, calling the complex owned by state mining investment firm ZCCM-IH a "critical asset" for the country's copperbelt.

There are 10 suitors for the mine and smelter complex, including South Africa-listed mining firm Sibanye-Stillwater and "one or two" Chinese mining firms, Kabuswe said in an interview on the sidelines of the Mining Indaba in Cape Town.

Sibanye CEO Neal Froneman in October told Reuters the company was interested in Mopani.

"There is interest from all over, including the Arab world," Kabuswe said, declining to name any of the other interested parties.

Asked about the competition for African metals and minerals pitting the United States and Europe against China, Kabuswe said Zambia did not differentiate between investors provided they brought value into the country.

"We are dealing with the Arab world, we are dealing with the U.S., we are dealing with China, we are not biased towards anyone," Kabuswe said. "We are friendly to everybody."

Zambia is also aiming for an agreement with Konkola Copper Mines owner Vedanta Resources by the end of the first quarter, Kabuswe said. Zambia last year decided to seek an out-of-court settlement with Vedanta after a lengthy dispute over KCM.

Increasing Zambia's copper production is necessary to reduce the country's debt burden, Kabuswe said, as growth in the mining industry will trigger investment in infrastructure and other sectors.

Zambia has set a goal of increasing copper production to 3 million tonnes a year by 2032. The country is struggling to cut debt after becoming the continent's first COVID-era default in 2020.

Zambia Is Back: Unlocking Zambian Potential In 2023

In 2022, the New Dawn government set out to release supply bottlenecks, remove unnecessary red tape and create an economic environment that nurtures investment and businesses. Following the 2023 budget, it is clear that the upcoming year is going to be monumental for Zambia’s economic recovery, with the rate of GDP growth forecast to increase by nearly 4% and a debt restructuring agreement firmly on the horizon. It has never been a better time to invest in Zambia.

As we look to 2023 one thing is for sure, Zambia’s economy will continue to thrive; blossoming into a new investment hub for Africa. Following years of economic instability and financial hardship, key economic indicators are now painting a positive picture. According to Bloomberg, in December, inflation fell to below 10% for the first time in almost three years and that rate is expected to average out at 8.5% in 2023. This fall in inflation shows that Zambia is not just welcoming investors but has an economy that can support them. Stable and low inflation reduces uncertainty and price distortions creating an environment to nurture investments, ensuring ample returns to businesses. This was highlighted in February last year when S&P Global Ratings improved the country’s credit rating. As a result, the Zambian economy continues to be one of the most economically stable investment environments in southern Africa, instilling confidence in investors around the world.

Outside of these top-level indicators, 2022 was an immensely successful year for foreign investments in key sectors of Zambia’s economy, such as agriculture, mining and tourism. In December, for example, the Radisson Blu hotel group opened a new resort on the banks of the Zambezi – the group’s first ever safari resort in Africa. The new resort will boast luxury rooms which include panoramic views across the Zambezi river.

Radisson Blu Resort Mosi-oa-Tunya — Photo by Radisson Hotel Group

Elsewhere, PHYLA Earth, who use genetically modified seeds to improve crop yield, announced that they will be developing a remarkable orchard in Chingola to combat soil erosion. The programme will see 4,000 Pongamia seedlings be planted near the Konkola Copper Mine. These are expected, once they have grown, flowered and produced seeds, to improve soil fertility in the area. This in turn will support local farming and increase ecological resilience, something that in the face of a climate crisis is of more importance than ever.

Moreover, Zambian Breweries, owned by the multinational giant AB InBev, announced they would be investing $80 million in capital investments to expand their Lusaka factory and create 5,000 jobs. The investment will also target more sustainable means of production, with 90% of the funds dedicated to innovating high-tech equipment to make operations more environmentally friendly. This includes the enlargement of the company’s agriculture out-grower schemes to offer more procurement opportunities to local suppliers.

Zambian Breweries Staff at the Lusaka brewery plant

Perhaps the pinnacle for investments in 2022 was achieved during the US-Africa Leaders’ Summit, when KoBold Metals announced their $150 million pledge to develop the Mingomba copper-cobalt mine. The new project uses cutting-edge AI technology to find new metal deposits; edging Zambia even closer to its copper production target of 3 million tonnes by 2032.

President and Founder of KoBold, Josh Goldman, said that he chose to invest in Zambia due to its economic stability and pro-business policies. He said that Zambia is a “safe and peaceful place where we can hire exceptional people, where the laws support investing for the long term, where we can operate in ways that protect the environment and support local communities and where government supports our investment with actions that are fair, transparent and fast.”

The investment hopes to break into the estimated 247 million tonnes of ore with some of the highest grade of copper found throughout the world. The quality of copper will be vital in providing batteries which can be used in renewable energy and electric vehicles. It is estimated that the global copper industry will need $100 billion worth of investment to meet its current demand by 2030. This presents a key opportunity for Zambia to enable mining profits as well as power inclusive growth.

These investments as a whole will have a multitude of positive multiplier effects on almost all aspects of Zambia economy, leading to more benefits to Zambians. Through the New Dawn government’s reformed tax system, the more companies that invest into Zambia the more revenue that can be collected. As this increases more government spending can be allocated towards infrastructure such as roads, healthcare and schools.

Outside of increased government revenue, high levels of international and domestic investment will see business capacity increase, resulting in higher employment opportunities, arming Zambians throughout the country with high-quality working prospects.

The US-Africa Leaders’ Summit also represented a pivotal moment for African leaders to meet and discuss global issues. Speaking about the KoBold investment, President Hakainde Hichilema made it clear that international cooperation is key as the world faces a myriad of uncertainties. “This investment today is not [just] about Kobold and ZCCM, it’s not about Zambia,” he said. “It’s about all these and the rest of the world as we grapple with climate change issues, as we grapple with replacing climate damaging fuels with green fuels, and therefore electric vehicles, very, very important to us.”

President Hakainde Hichilema, pictured at the summit alongside U.S. Secretary of State Anthony Blinken

Looking ahead to 2023, the World Economic Forum meets in Davos this week, presenting Zambia with another opportunity to market itself on the world stage. The event will host over 2,700 leaders from government, business and civil society, meeting to discuss topics, ranging from agriculture to the conflict in Ukraine, to digital infrastructure.

Zambia will be represented by Finance Minister Situmbeko Musokotwane, who will be looking to advance relationships with international partners, as well as representatives from the private sector to further boost sustainable investment into Zambia and advance our country’s reputation as a premier location to do business on the African continent. Last week, the World Economic Forum published an article outlining that even in the face of global economic uncertainty more businesses than ever are looking to emerging economies, such as Zambia, to meet their ambitious business plans. This is exactly why Zambia should be putting itself in front and centre to welcome more foreign investments, leading to tangible benefits for Zambians throughout the country.

Promoting investment is key to the work we do at Zambia Is Back. We work alongside the New Dawn government and the Zambia Development Agency to connect Zambian businesses with investors from around the world to make it easier than ever to do business in Zambia.

Now is the time to invest in our nation and we are excited to meet with more businesses to unlock Zambia’s potential. This year marks a new chapter in Zambia’s history and we are looking forward to seeing what is in store for businesses over the next few months and helping to coordinate investments that promote all aspects of our economy and its communities.

Zambia’s Role in the Green Energy Transition

Zambia is well positioned to provide the world with the minerals it needs to transition to renewable energy.

With its significant reserves of copper and cobalt, metals that are fundamental to the transition away from fossil fuel reliance, it has the potential to provide global supply chains with crucial components for years to come.

These minerals are used not only in wind and solar powered technology, but are also fundamental to the production of batteries used in electric vehicle production.

Transitioning to electric vehicles and increased energy supply via renewable sources is fundamental to the shared global commitment to keep global warming below 1.5 degrees. In the words of the United Nation’s Net Zero Coalition “replacing polluting coal, gas and oil-fired power with energy from renewable sources, such as wind or solar, would dramatically reduce carbon emissions.”

Consequently, according to the International Energy Agency, Copper demand is expected to three times its current level by 2040, while cobalt demand is expected to rise more than twenty times.

Zambia accounts for 6% of the world’s copper reserves. It produces 850,000 tonnes of copper annually, making it the world’s 7th largest producer but with government focus and foreign investment this is expected to rise significantly.

Canadian firm First Quantum Minerals (FQM) have committed to a $1.25 billion dollar investment into the Kansanshi copper mine as a reflection of their “renewed confidence” in Zambia’s investment climate. The investment is designed to expand the mine and seize the opportunity rising international demand presents.

President Hichilema is keen to see Zambia meet the global rising demand in order to spur economic growth. A key part of the UPND’s growth strategy, designed to steer the country into a period of middle income prosperity following the instability of the Lungu years, is the commitment to increase copper production more than three times over.

By 2030, it is hoped Zambia will produce 3 million tonnes of copper a year – that represents an impressive 352% increase in production on a commodity that already accounts for 80% of the country’s export earnings.

Copper is critical for solar PV, wind, hydro, electric vehicles and national electricity grids, there are few metals more fundamental to a green transition. Zambia is placed in an extraordinary position to spur its own economic take-off and to foster a status as a crucial player in the fight against climate change.

This is why during December’s US Africa leaders’ summit, held in Washington, D.C. leaders from Zambia, the Democratic Republic of Congo, and the US signed a memorandum of understanding to develop an electric vehicles battery chain.

It is also why US-based firm KoBold Metals have announced a $150 million development into the Mingomba copper-cobalt mine in the country. The Bill Gates backed startup aims to use artificial intelligence to create a map of the Earth’s crust, identifying areas with the highest concentration of cobalt and copper deposits in order to locate minerals overlooked by traditional exploration as the earth’s most accessible minerals have increasingly already been mined. The company’s CEO is absolute: he does not see KoBold as a mining operator but a leader in the “electric vehicle revolution.”

Because copper is a highly efficient conductor, it is used in electric cabling and its efficiency reduces wastage. It is also one of few materials that can be used again and again without a loss in performance. Copper plays an important role in making energy production as efficient as possible with minimal impact on the environment.

Traditionally, Zambian government have sought to extract the greatest possible tax value from the mining industry. However, the New Dawn government have reduced the tax payable on new mines in order to encourage further exploration, induce investment, and create the greatest possible economic gain for the entire Zambian economy, not just the government’s coffers.

In this new climate, mining giant Barrick Gold has recently announced record yields from its Lumwana copper mine. Crucially for Zambia’s future, the company’s presence in the country has benefits beyond corporate and treasury income. Barrick Gold employ more than 4,000 people in the country, 99.3% of those are Zambian nations benefitting from the firm’s employment. It has been estimated that when royalties, taxes and local employment are combined, the firm have contributed $8.2 billion to the country’s economy.

In the past, Zambia has not taken full advantage during copper booms. From 2003 to 2006 the price of copper tripled, Zambia’s economic growth rate also grew, but poverty and income inequality remained unaffected.

Without integrating the benefits of foreign investment into the broader economy, Zambia could once again fail to capitalise on the opportunities presented by its extraordinary natural resources. By encouraging foreign firms to employ Zambia workers in the mine, in catering, housing, security, and to executive positions within local structures.

As optimism grows that Zambia can play a leading role in a transformed world, there is hope that President Hichilema can create meaningful change for Zambians.

PE-Backed Firm Helps Zambia Become Africa’s Top Stock Performer

Bloomberg, January 3, 2023

Copperbelt accounted for majority of the Zambian index’s gains

Lusaka’s benchmark index has jumped 12% in dollar terms

A rally in Copperbelt Energy Corp. helped Zambia’s benchmark stock index become Africa’s best performer this year.

The 22-member Lusaka Securities Exchange All Share Index climbed almost 12% in dollar terms in 2022, its second straight year of gains. Copperbelt, which supplies power to mining companies in Africa’s second-biggest copper producer, contributed most to the index’s advance.

Local investors piled into the power supplier’s stock after the government of President Hakainde Hichilema, who was elected in August last year, helped resolve a dispute the company had with the previous administration. The gains in the company’s shares may continue next year, according to Charles Mate, founder of Stockbrokers Zambia Ltd.

“What we have seen really is a resurgence in terms of investor interest, especially from the domestic market,” Mate said. “This stock still has significant upside.”

Lusaka Securities Exchange performance since January 2020, via https://luse.co.zm/

Copperbelt, which is more than a third owned by private equity firm Affirma Capital Singapore Pte, since 2020 was locked in legal wrangle with the government. The disagreement began dissipating in January.

With a trailing price-to-earnings ratio of about five times, Copperbelt Energy is still undervalued, said Mate, who helped set up the local stock exchange in 1994 and was its first general manager.

By Matthew Hill

‘Momentous’ Day for Zambia as US-Africa Summit Draws to a Close

As the US-Africa Leader’s Summit draws to a close, President Hichilema has praised “a momentous day for the people of Zambia” as the U.S. company KoBold Metals announced a $150 million dollar (K2,654,442,000) investment to explore and develop Zambia’s Mingomba Copper Mine.

This exciting partnership is set to create jobs for Zambian citizens whilst reinvigorating an underutilised national asset. The deal constitutes part of a highly successful trip that included numerous partnerships, public talks, and a meeting with the President of the United States, Joe Biden.

The trip represents an important step in strengthening Zambia’s economic outlook and amplifying its international reputation as promised during the 2021 election campaign. President Hichilema has utilised the newly agreed IMF Extended Credit Facility to drive foreign investment, foster macroeconomic growth, and more than half the rate of inflation since coming to power.

Zambia’s newest investor, KoBold Metals, is seeking to generate a return on their investment by developing the underutilised copper deposit at Lubambe Copper Mine. Under the terms of the agreement, KoBold will pay EMR Capital, the 80% shareholder of the Lubambe Mine, $115 million to develop the existing mine whilst acquiring a majority stake in the Mingomba copper deposit. Backed by Bill Gates’s Breakthrough Energy Ventures, KoBold seek to use artificial intelligence to responsibly mine for the rare earth metals that are central to the construction of electric vehicles and smartphone technology.

Hichilema speaks at the U.S. Africa Business Forum following the announcement of KoBold Metal’s historic investment. Image via Twitter (@usembassyzambia)

Mingomba represents KoBold’s largest investment yet, estimated to contain over 9 million metric tons of copper. However, as yet it has not been determined where the mineral resources end on this site. It is hoped new technology will help answer this question. As global concerns grow over the scarcity of rare earth metals, the firm seeks to use AI to guide where to procure land, what data to collect, and where to drill in order to find the precious commodities hidden further under the earth’s surface.

“Converted to copper contained in electric vehicles, it’s like 100 million electric vehicles [contained within the mine],” according to KoBold’s President, Josh Goldman.

Speaking in Washington on Wednesday, President Hichilema emphasised that to meet the country’s growth ambitions “new ideas, and new technology” must be utilised. President Hichilema has repeatedly stated his ambition to more than triple Zambia’s annual copper production to 3 million metric tons. Utilising AI to get the most out of dormant or under-utilised sites such as this can unlock one of the highest-grade copper resources in the world. Initial discoveries were first made at the two sites in the 1920s but as mapping technology improves, its true potential is increasingly unveiled.

Michael Gonzales, U.S. ambassador to Zambia, told the press that the deal “sends a powerful signal that the U.S. and its allies can and will compete successfully for the minerals and resources that will power the global clean energy transition.”

The deposits are located in the rich Central African Copperbelt, the same area in which the Kansanshi copper mine is located. Earlier in the year, First Quantum Minerals Ltd. approved a $1.25 billion project to extend mining operations at Kansashi. Zambia and the Democratic Republic of the Congo recently signed a Memorandum of Understanding in which the U.S. will support the two countries in further developing an electric vehicle value chain. Such extensions will prove vital in the realisation of the goals set out in the memorandum.

Zambia and the DRC sign an MoU on electric vehicle value chains at this week’s summit. Image via Twitter (@HonKakubo1)

Speaking recently at the 5th Annual Corporates and Diplomats Gala in Lusaka, the U.S. ambassador praised the “excellent strategies and policies” being implemented by the government. “If the government is going to continue implementing these strategies, the country will go far in terms of development.”

The Government of Zambia has made particular efforts to induce foreign direct investment through its recently launched Zambia is Back campaign. The campaign seeks to help companies and financiers work alongside the government and to connect them with local private sector partners to foster growth. Tax concessions have also been introduced for 2023 in the manufacturing, tourism, and green energy sectors with a view to maintaining 4% year-on-year growth and achieving middle-income status by 2030.

Owing to its young, growing populations and the rich deposits of rare earth minerals that are set to prove so vital to the future of electric cars and smartphone technology. In this context, President Biden is courting African leaders for their friendship and support. Sites contained within the Central African Copperbelt have world-leading deposits of cobalt and lithium which are vital in the Sino-American competition to lead innovations in next-generation computing and decarbonisation.

The Biden administration is now openly supporting proposals to include the African Union (AU) in the G20. This is a clear move to recognise the importance of the continent and suit its leaders. Such a move would make the AU the second regional body recognised by the forum for economic cooperation after the European Union. The group already accounts for 85% of global GDP, and 65% of the world’s population. The inclusion of African nations would further bolster the global standing of the group whilst increasing the ability of African nations to determine the global political and economic agenda.

President Hichilema meets Joe Biden, President of the United States of America, and First Lady Jill Biden. Image via Twitter (@HHichilema)

President Biden has also raised the prospect of expanding the UN Security Council to include permanent representation for Africa. The move may be unpopular in some circles as ultimately expansion is dilution within the Council, but Biden is seeking an era of more equitable partnerships between African nations and foreign powers. Just last week, Judd Devermont, senior director for African Affairs at the National Security Council commented that “it’s past time Africa has permanent seats at the table in international organisations and initiatives… we need more African voices in international conversations that concern the global economy, democracy and governance, climate change, health and security.”

In a further deal sealed at the summit, Zambia will be partnering with USAID through the Prosper Africa Initiative to address the global food security crisis. Highlighting the impact of the war in Ukraine in exacerbating global shortages, USAID has pledged to match private sector investment 1:1 to magnify the impact food security initiatives can have on the continent. The partnership between Africa Global Schaffer, Bechtel, and the Export Trading Group will begin in Zambia by building green, Smart Integrated District Aggregation Centers to improve the production and efficiency of maize – a crop that commonly experiences high post-harvest losses. The partners will utilise equipment to protect post-harvest crops whilst the centers will be designed to connect sellers with buyers at key points along vital East African trade routes. One-third of these centers will be run by female smallholder farmers. Eliminating post-harvest maize loss has the potential to provide over 1.5 million Zambians with their necessary daily calorie requirements and improve nutritional outcomes.

Hichilema meets Senator Menendez the chairman of the Senate Foreign Relations Committee. Image via Twitter (@SFRCdems)