Barrick Gold to Upscale Production at Lumwana Copper Mine

The Canadian-based mining company Barrick Gold has announced that it will be transforming Zambia’s Lumwana copper mine into a ‘Tier One’ asset. Tier One classification means that the mine has been recognised with a reserve potential of greater than 5 million tonnes of contained copper and C1 cash costs per pound in the lower half of the industry cost curve, enabling it to upscale production.

Barrick initially acquired the mine in July 2011 and have been focussing on gradual expansion since 2019, however, due to the recent discovery of new expansion possibilities, the Barrick president and chief executive Mark Bristow said Lumwana’s full potential was “only now being revealed”.

The Zambian mine is considered as one of the largest copper supplies in the world with an estimated 5.014 billion pounds of proven and probable copper reserves of ore grading 0.68% copper. The mining licence held by Barrick covers 1,355km², which is equivalent to 253,213 football fields or works out to nearly twice the size of Singapore.

Additionally, informed by an updated geological model and the latest indications of higher ore grades at Kababisa and Kamaranda, Barrick has increased their investment into Lumwana, both upscaling the production and extending the life of the mine from 2042 to 2060.

Image: Barrick Gold

This investment towards increased copper production will directly result in a greater contribution to the nation’s economy.

Investment into the Local Community

So far, Barrick has purchased approximately US$4.3 billion in goods and services from local Zambian registered businesses since the Lumwana mine went into production in 2011, with $432 million being spent on local procurement expenditure in last year alone (83% of the mine’s total procurement spend).

Moreover, Barrick has repeatedly directed portions of the mine’s profits into the local Zambian community, adding essential infrastructure to Lumwana’s education, transport, water supplies, hospitals and more. The company has also launched a “Business Accelerator Program” which aims to build the capacity of Zambian contractors in the mining supply chain and increase job security. The program assists their expansion plans, diversifies their markets, and fosters independence and sustainability beyond Lumwana's lifespan.

Finally, Barrick has significantly contributed to Lumwana’s community through employment, and the mine currently holds industry leading levels of local workers with 99.3% of employees and 98% of contractors being Zambian nationals. Overall, US$176 million has been paid in form of salaries to Zambian nationals since 2019.

Importantly, as Barrick upscales their production, more money will be spent on local businesses, more donations will be made to the local economy, and more Zambians will be employed- all at a faster rate.

Photo: BGStock72 / Shutterstock

Future Possibilities

As international companies and banks look to safer investments due to current economic instability, almost all look towards purchasing shares in gold, with many investing in Barrick, as the world’s second largest gold company.

Barrick’s growth is encouraging news for the Lumwana mine, meaning that production might even be extended past 2060, and affirming that the probability of the company selling the copper reserve is very low.

Amazingly, this increased investment comes after the gold giant prepared to sell the copper mine in 2019 due to tax changes under Edward Lungu’s government.

The previous president attempted to enforce a 5% copper import duty, plans to replace value-added tax with a non-refundable sales tax, and an added royalty on copper productivity. Following this, Barrick broadcast that it was looking into Chinese investors with plans to sell Lumwana by the end of 2019. The sale process was indefinitely halted after the current government introduced tax breaks in 2022, immediately following this Barrick scaled up production, specifically noting that the revised tax regime freed up cash flow to invest in Lumwana.

In transforming the Lumwana copper mine into a Tier One asset, Barrick aims to achieve the Government’s target of reaching 3 million tonnes (MT) of copper production in the next 10 years through increased investment into the mining process.

Investment into Zambia

Barrick’s recent investment into Zambia is part of a larger international trend with companies announcing new ventures into the Zambian economy almost daily, signalling an increased level of trust for the stability of the nation’s economy under President Hakainde Hichilema’s administration.

In an interview discussing the mine, Bristow stated that “We all agree that President HH has brought a certain stability to the country, he has definitely made the country more investable”, a comment which emphasises a global faith in Zambia’s economy and government.

First Quantum Minerals -Production Starts at Africa’s Biggest Nickel Mine

First Quantum Minerals, a global copper company with reserves of nickel, gold, and cobalt, has officially commenced production on their nickel mine situated in the North-western Province of Zambia.

The Canadian mineral firm is one of the world’s top 10 copper producers and has been partly situated in Zambia since 2005, owning various mines in the country, including Kansanshi which produces more copper than any other mine in Africa.

However, it is the Enterprise nickel mine that First Quantum is currently focussing on, the sediment-hosted nickel-sulphide deposit has been estimated to hold 40 million tonnes of ore and contain 431,000 tonnes of nickel.

Yesterday, on July 26, mining output started on the mine and a new concentrator, set to increase the efficiency of mineral processing, is expected to be commissioned early next month by the Minister of Mines and Minerals Development Paul Kabuswe.

The mine is expected to upscale annual production to nearly 30,000 tonnes of nickel over the next two years, according to First Quantum’s project manager Axel Köttgen.

This increase would make Zambia the largest producer of the metals needed to manufacture batteries for electrical vehicles, a prospect which aligns with the government’s intention to become a major trader in the emerging market of EV batteries.

Internationally, critical supplies of battery minerals are being pursued by countries such as China and the US. Nickel, as a central component of most EV batteries, holds a specific importance in this global rush to secure battery metals.

In addition to this recent investment, First Quantum approved a $1.25 billion expansion project for their Kansanshi copper mine in Zambia last year. A decision the company stated was provoked by a “renewed confidence” in Zambia's investment climate due to the work of the current government.

First Quantum’s increased funding for Zambian assets follows a larger trend of investment into the country, with companies regularly publicising developments into the Zambian economy, ultimately evidencing the restored level of trust in the stability of the nation’s economy under President Hakainde Hichilema’s administration.

Great Future Beckons for Lumwana as Barrick Unlocks Potential

Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) – Barrick’s drive to transform the Lumwana copper mine into a Tier One asset with a life extending beyond 2060 is picking up speed with a strong performance in the past quarter adding impetus to its continuing production ramp-up.

Briefing media at a site visit here today, Barrick president and chief executive Mark Bristow said the mine’s full potential was only now being revealed. Additional expansion opportunities, identified through an updated geological model, are currently being assessed, while drilling at the Kababisa prospect highlights potential mining flexibility through higher grades. The Lumwana pre-feasibility study is progressing in line with our plans to transform its long-term copper profile through the delivery of the envisioned super pit.

“Since Barrick refocused its strategy in Africa in 2019, Lumwana has become a key element in the expansion of our strategic copper portfolio and a significant contributor to our bottom line. At the same time its importance to Zambia has grown. Since 2019 it has contributed more than $2.3 billion to the country’s economy in the form of royalties, taxes, salaries and purchases from local suppliers,” he said.

Barrick has a global policy of sourcing its suppliers locally and last year it spent $432 million, 83% of its total procurement, with Zambian suppliers and contractors. It has also launched a “Business Accelerator Program” to build the capacity of Zambian contractors in the mining supply chain.

Similarly, Barrick is committed to local employment. Currently 99.3% of Lumwana’s employees and 98% of its contractors are Zambian nationals, both industry-leading statistics.

Lumwana is a participant in the United Nations’ REDD+ project, which is designed to reduce greenhouse gas emissions from deforestation, and the mine has engaged with its communities on this initiative.

Zambia Debt Restructuring: What You Need To Know

On 22 June, Zambia announced that it had reached an agreement on comprehensive debt treatment according to the G20 Common Framework, just over 30 months after first defaulting on its debt. But what are the terms of the new debt arrangement?

How Much Does Zambia Owe?

Major bilateral creditors, including France and China, have agreed to restructure loans totalling to $6.3 billion.

Among the deals’ clauses was an obligation for “comparability of treatment for Zambia’s commercial debts”, guaranteeing that the $6.8 billion owed to private sector creditors would also be restructured according to the G20 Common Framework.

In total, $13.1 billion will be restructured under the deal.

How Will These Be Paid Off?

Zambia’s debts have been reorganised to be paid over a 20-year period with a three-year grace period. Zambia will only have to pay the interest rate on its loans until 2026, and will have until 2043 to conclude debt repayment, an extension of the previous deadline by 12 years.

Zambia’s rate of interest will be capped at 1% until 2037, and will rise to a maximum of 2.5% for the remainder of the loan. Zambia has been paying an average of 3.9% on its Chinese bilateral loans. Interest rates may rise to a cap of 4% if Zambia is upgraded from a low to medium debt carrying capacity.

Also included in the restructuring is a loan to cover the ongoing construction of the Kafue Gorge Lower hydroelectric powerplant.

What Does This Mean For Zambia

The deal also means that Zambia has fulfilled the requirements for the IMF to disburse its second instalment of $188 million agreed in April, which will be injected directly into the Zambian economy.

When President Hichilema returned to Lusaka’s Kenneth Kaunda International Airport, he said that the deal created the conditions necessary for Zambia to “rebuild confidence in our economy, attract foreign investment, and unlock the potential of our natural resources”.

Analysts expect Zambia’s bondholders to also strike a debt restructuring deal with the government in the coming weeks. This would secure a plan to pay back some $3 billion owed to private lenders. Optimism is particularly high after the bilateral debt deal saw the Zambian government pledge to speed up its repayments as the economy improves.

Zambia state firm says Zijin, Sibanye interested in copper mine

LONDON, June 26 (Reuters) - Zambia's state-owned ZCCM Investment Holdings (ZCCM.LZ) confirmed on Monday that China's Zijin Mining (601899.SS) and Sibanye Stillwater (SSWJ.J) are among investors short-listed to buy Mopani Copper Mines.

The list includes those companies, China's Norinco Group and an investment vehicle owned by ex-Glencore officials, Reuters reported June 20, citing sources.

The search for a new investor for Mopani is likely to be concluded within the next two months, ZCCM-IH CEO Ndoba Vibetti told Reuters at a mining conference in London. The mine would require at least $1 billion in funding over the next five to six years, Vibetti said.

Attracting a new investor at Mopani is part of the government's plan to triple copper output in Africa's second-largest producer over the next decade.

The Mopani mine and smelter complex currently requires around $200 million to $300 million of short-term funding to make it sustainable, Vibetti said, adding that it has taken a long time to find a new investor because they needed a suitable company to takeover Mopani.

"Part of the reason that has taken so long is to get that packaging right," Vibetti said. "Somebody who can come, bring it out of water and then be able to invest for the long term."

Switzerland-based commodities giant Glencore (GLEN.L) sold a 73% stake in Mopani to ZCCM-IH in 2021 for $1.5 billion in a deal funded by debt, but it retained offtake rights to Mopani's copper production until the debt had been repaid in full.

This article originally appeared on Reuters

Debt Restructuring Deal Puts Zambia Back in the Champions League

After months of build-up and years of waiting, Zambia has arranged a historic deal to restructure more than $6 billion in debts owed to foreign creditors.

The deal, which will rearrange the structure of the money lent bilaterally to Zambia by nations including China, marks the first major debt relief assigned to a developing country within the Group of 20 (G20)’s Common Framework. Public sector creditors have agreed to reschedule $6.3 billion of debt, $.1.3 billion of which were accrued arrears.

The news was announced by a French official, and later confirmed by Zambia’s finance ministry, ahead of the Globate Climate Finance conference being held in Paris. The summit’s aims include combatting poverty, fighting climate change and reaching “climate solidarity” between developed and developing nations. The same official disclosed that the Memorandum of Understanding contains a clause “requiring comparability of treatment for Zambia’s commercial debts”, guaranteeing that private sector creditors will follow the G20 Common Framework and restructure the $6.8 billion they are owed, meaning that a total of $13.1 billion in debt is to be repackaged.

Presidents Macron and Hichilema greet each other outside the conference. (Hakainde Hichilema / Facebook)

Details are expected to emerge in the coming days once Zambia has formally accepted the debt relief, but an anonymous member of the Paris Club confirmed that China and India had agreed to terms with traditional creditor nations of the Club. It is further understood that the creditors have unilaterally agreed to extend the repayment deadlines for loans by 20 years, with an initial three-year grace period also among the terms.

The memorandum that will be signed will be historic for a number of reasons. The relief will address the debt Zambia incurred when it became the first African nation to default on COVID pandemic-era national debt; the arrangement is the first significant restructuring agreed within the G20 Common Framework; and the deal is likely to lead the way for other struggling nations, including Ghana, Sri Lanka and Ethiopia, whose talks with major creditors have all recently stalled in similar fashion to those of Zambia in the spring.

Janet Yellen, the U.S. Treasury Secretary, mentioned that debt relief was an urgent priority for Ghana and Sri Lanka upon arriving in Paris on Wednesday, when she hinted at Zambia’s debt deal being “very close”. Yellen has been a central figure in the revitalisation of multinational discussions on Zambian debt resolution, and drew attention to the urgent need for round-table talks during her visit to the nation as part of her January 2023 tour of Africa.

Secretary Yellen with President Hichilema during her tour of Africa in January 2023 (Saul Leob / Getty Images)

The deal has yet to be signed; its announcement, nonetheless, has had an immediate and profound impact. Zambia’s currency has rallied 12% this month, making the kwacha the fastest-growing of the 150 currencies monitored by Bloomberg. The 12% increase is the greatest growth the kwacha has enjoyed in more than 7 years. Zambia’s eurobonds, meanwhile, have returned 10.1%, a figure bested only by El Salvador and Argentina.

In October, Zambia’s treasury secretary, Felix Nkulukusa, said that the country was seeking to restructure 12.8 billion in external debt. Nkulukusa also explained that reducing foreign holdings of domestic debt would release funds for other creditors such as China. It is suspected that a significant portion of this initial $6.3 billion package will be committed to servicing debt holdings.

The Paris Club official also disclosed that the $4.1 billion owed to the national Export-Import Bank of China formed the majority of the $6.3 billion package, which is publicly known to have been funds owed to government bodies. They added that Beijing was wary to be seen holding up debt relief for Zambia at a summit attended by 40 world leaders designed to ease debt burdens for developing nations and free up finances for climate initiatives. President Macron’s meetings with Chinese authorities in Beijing in April are understood to have had a significant impact on yesterday’s final talks.

Presidents Macron and Xi in April. (Eliot Blondet / Sipa USA)

Eswar Prasad, professor of economics at Cornell University, said that China’s “endgame seems to be a resolution that limits its financial losses while spreading more broadly the blame for the distressing and untenable situation that many highly indebted economies find themselves in”. The International Monetary Fund has estimated that 70 of the lowest-income nations are burdened by a collective $326 billion in debt; more than half of those same nations are in, or reaching, debt distress.

Ghana and Ethiopia have been locked in talks with creditors for months, their debts dominated by loans from China. It is hoped a solution to their plight will be agreed by the conference’s conclusion.

The scale of Zambia’s debt had been a cause of concern for major Zambian creditors and potential investors, compounding its repercussions. Financing assurances were provided by Zambia’s biggest creditors in July 2022; reports in January 2023 expected restructuring to take place in March. In May, two months after debt relief was supposed to have been arranged, Zambia’s central bank was forced to raise inflation by 25 basis points to 9.5%. Growth in 2022 reached 4.7%, despite Zambia’s distressed status, but forecasts expected a drop to 3.6% in 2023. The IMF guaranteed a $188 million financing disbursement in April 2023, to be released once debt was restructured; Zambia has been waiting patiently for this immediate boost to their economy ever since.

Finance Minister Musokotwane during July 2022 negotiations. (Zinyange Auntony / Getty Images).

Kristalina Georgieva, managing director of the IMF and another vocal supporter of Zambia, issued a statement on Thursday, which read, “Today we will talk about Zambia, which I think is a great case of celebration because it makes debt restructuring agile and effective”. Visiting Lusaka in January 2023, Georgieva committed to assisting “Zambia on its journey towards a more resilient and inclusive future”. She said that she was “hugely impressed by Zambia’s enormous potential given its rich endowment of natural resources, and a dynamic and entrepreneurial youth population”. She praised Zambia’s “efforts to improve the use of public resources by reallocating resources from poorly targeted and inefficient spending and redirecting them to much-needed spending on education and health”, and asked creditors for “swift resolution of its debt situation to complement these reform efforts and preserve the positive growth momentum”.

In April, Georgieva accompanied a trip of IMF staff to Zambia, and told reporters that “The ball is truly in the court of the creditors”. Georgieva and the IMF’s unrelenting support for Zambia has been critical in adding much-needed optimism to the discussion of Zambia’s debt relief and highlighting the role that China and private creditors could play in Zambia’s return to economic good health.

IMF Managing Director Georgieva in Chongwe, Zambia. (Kim Haughton / IMF)

This morning, Hakainde Hichilema, President of Zambia, spoke before delegates at the New Global Financing Pact at Palais Brongniart, Paris. He thanked Presidents Macron and Xi, along with other major creditors. Hichilema concluded his speech with a familiar refrain: “Zambia is back in the Champions League”.

Four firms shortlisted in race to buy Zambia's Mopani Copper Mines - sources

June 19 (Reuters) - China's Zijin Mining (601899.SS) and Norinco Group, South Africa's Sibanye Stillwater (SSWJ.J) and an investment vehicle owned by ex-Glencore officials have been shortlisted in the race to buy Zambia's Mopani Copper Mines, two sources with knowledge of the matter told Reuters.

Zambia's mines minister Paul Kabuswe said in February there were 10 suitors for the mine and smelter complex that is owned by state firm ZCCM-IH.

Rothschild & Co, hired last year to find investors for Mopani, has whittled down the list to four, the sources said.

Switzerland-based commodities giant Glencore (GLEN.L) sold a 73% stake in Mopani to ZCCM-IH in 2021 for $1.5 billion in a deal funded by debt, but retained offtake rights of Mopani's copper production until the debt had been repaid in full.

One of the sources said the investors, who conducted due diligence and submitted non-binding offers in May, are now completing all the work required before making binding offers, with Sibanye, Zijin and Norinco the three strong contenders.

The source added that an investor is expected to be selected before the end of July, and that separate proposals have also been made to Glencore, which is still owed money.

Glencore also made further loan advances to Mopani in 2022.

Reuters was not able to establish the value of the deal.

A spokesperson for Glencore declined to comment. Zijin also declined to comment, while Norinco and ZCCM-IH did not immediately respond to emailed questions.

Sibanye CEO Neal Froneman, who is seeking to expand in copper as part of the company's push into green metals, confirmed the company had submitted a proposal to acquire Mopani.

"We are willing to invest, we are willing to be there for the long term," Froneman told Reuters in an interview.

Froneman said the copper mine, which could potentially produce about 225,000 tonnes of copper annually, required considerable investment, but that the available deposits made Mopani a good asset to own.

"It's a wonderful orebody, and a good mine starts with a good orebody and good people," Froneman said.

Zambia's President Hakainde Hichilema is seeking to attract new investors in Africa's second-largest copper producer, and wants to triple output of the metal that is key to products from power lines and industrial machinery to electric vehicles.

Zambia’s Creditors Close to Debt Restructuring Deal, IMF Says

Zambia’s creditors are close to agreeing to a long-awaited debt restructuring deal that will allow the International Monetary Fund to disburse $188 million to the distressed African nation.

“We’ve had initial agreements to provide financing assurances so the IMF can proceed with providing financing with Zambia,” Abebe Aemro Selassie, the fund’s director of the African Department, said during a panel at the Bloomberg New Economy Gateway Africa forum in Marrakesh, Morocco, on Tuesday.

Zambia’s official creditors committee met earlier this month to discuss proposals for a “specific debt treatment” after the country’s Finance Minister Situmbeko Musokotwane appealed to creditors for urgent debt relief.

The fund and Zambia are having “very very active discussions and we are very hopeful that something will come through in the next few weeks,” he said.

This article originally appeared on Bloomberg

Zambia Investor Briefing: May 2023

OVERVIEW

President Hakainde Hichilema travelled to the UK to attend the coronation of King Charles III and meet with delegates and investors. There, the president attended the Zambia Investor Forum and the Africa Debate in London, both hosted by Invest Africa. President Hichilema gave the keynote address at the Investor Forum, where he announced that Zambia is ready for business. There, Zambian Ministers met with key players in the agriculture, tourism, mining, infrastructure and energy sectors, negotiating investment opportunities. The president also gave a keynote speech at the Africa Debate alongside Andrew Mitchell, UK Minister of State for Development and Africa.

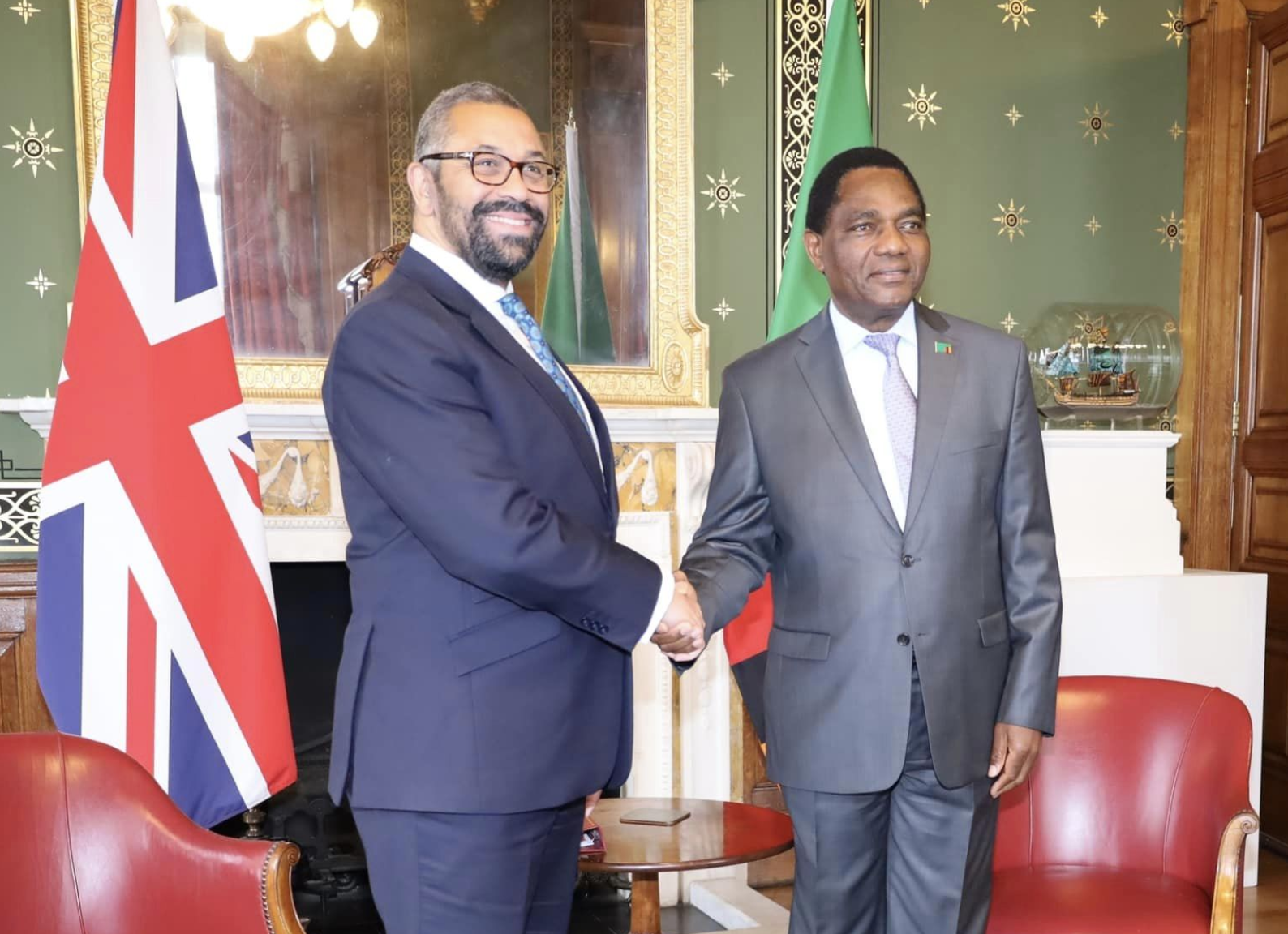

Over the course of the week he spent in England, Scotland, and France, Hichilema took part in 20 meetings with heads of state, delegates, and investors, where he discussed the country’s investment potential. These included meetings with Emmanuel Macron, President of France; Scotland’s First Minister, Humza Yousef; Han Duck-Soo, Prime Minister of South Korea; and James Cleverly, UK Foreign Secretary.

Whilst in attendance at the Africa Debate, Albert Halwampa, Director General of the ZDA, signed a Memorandum of Understanding (MoU) with Invest Africa’s Chairman (and former Africa Minister) Mark Simmonds. The purpose of the MoU is to promote foreign direct investment from the UK into Zambia. Other meetings at the sidelines of the Africa Debate and the Zambia Investment Forum yielded deals with a total of 162 companies.

President Hichilema met with officials from British International Investment (BII), including its CEO Nick O’Donohoe. The development finance institution has invested over $100 million in the Zambian economy, its main areas of interest being the country’s agricultural, energy, and financial sectors. According to Hichilema, the meeting was a means of demonstrating his government’s commitment to “providing an enabling environment for private sector to thrive”.

US President Joe Biden announced his country’s support for the development of the Lobito Rail Corridor, which would connect Zambia and the DRC to global markets through Angola. The US International Development Finance Corporation is currently performing due diligence for a potential financing package of $250 million. Biden stressed the effects of this investment on strengthening Zambia's trade, employment, supply chains, and food security. He made the announcement at the Partnership for Global Infrastructure and Investment (PGII) Meeting, held in Hiroshima, Japan.

Wasoko, a Kenyan retail-tech startup, has expanded into Zambia with a US$1 million investment for its first year of operations. The company leverages innovative technology to provide same-day delivery of essential goods and financing to informal retail stores across Africa. In March 2022 it banked a US$125 million Series B round. Zambia is its first expansion into Southern Africa, with its central hub based in Lusaka. Wasoko’s operations in the city will enable small retailers to access an affordable range of products for same-day delivery and working capital financing solely, accessed purely through a mobile app.

A Zambian delegation, led by Finance Minister Dr Situmbeko Musokotwane, attended the Annual Meetings of the African Development Bank (AfDB) in Sharm El Sheikh, Egypt. Among the bilateral talks held by the delegation were meetings with Dr Akinwumi Adesina, President of the AfDB, and Kevin Kariuki, AfDB’s VP for Energy, Climate, and Green Growth.

Zambia Investment Forum and The Africa Debate, London

President Hichilema travelled to the UK to attend the coronation of King Charles III and meet with delegates and investors. There, the president attended the Zambia Investor Forum and the Africa Debate in London, both hosted by Invest Africa.

Hichilema gave the keynote address at the Zambia Investment Forum, where he announced that Zambia is ready for business. He reiterated that his government was “committed to reforms – after all, we were elected on a ticket of change, to improve the lives and livelihoods of our people [...] through the economy”.

At the forum, Zambian Ministers – including Finance Minister, Situmbeko Musokotwane; Commerce, Trade, and Industry Minister, Chipoka Mulenga; and Foreign Affairs Minister, Stanley Kakubo - met with key players in the agriculture, tourism, mining, infrastructure and energy sectors to negotiate investment opportunities.

The president also gave a keynote speech at the Africa Debate alongside Andrew Mitchell, UK Minister of State for Development and Africa.

Hichilema’s Meetings in England, Scotland, and France

Over the course of the week he spent in England, Scotland, and France, Hichilema took part in 20 meetings with heads of state, delegates and investors, where he discussed the country’s investment potential.

Hichilema met with France’s president, Emmanuel Macron. The primary focus of the bilateral was Zambia’s debt restructuring programme. During Hichilema’s meeting with Scotland’s First Minister, Humza Yousaf, the latter confirmed Scotland’s investment of £1 million to a vaccine research laboratory in Zambia.

During his trip, president also met with Han Duck-Soo, Prime Minister of South Korea and James Cleverly, UK Foreign Secretary, and spoke at the UK Parliament’s Critical Minerals Association.

Currency

1 USD = 19.51 ZMW 30-day average = 18.510 Volatility (last 30 days) = 0.54%

OTHER NEWS

IMF chief ‘won’t let Zambia down’ as creditors hold up payment’, 05.05.23, Bloomberg

Zambia’s debt crisis is not easy to solve, 15.05.23, Mail & Guardian

Zambia raises key rate to three-year high on inflation pressures, 17.05.34, Bloomberg

China says it will work for better solution of Zambia’s debt issues, 19.05.23, Reuters

Muscle Maker acquires Zambia farmland for $8.5 million, 22.05.23, Yahoo Finance

Studious invests stand to benefit from opportunities in Africa, 25.05.23, Financial Times

Zambia urges official creditors to advance debt restructuring at next meeting, 30.05.23, Reuters

UPCOMING EVENTS

05-06.06.23 Africa CEO Summit Annual Forum ,Abidjan, Côte d’Ivoire

CONTACT US

If you would like to find out more or receive tailored briefings on specific sectors get in touch via info@zambiaisback.com. To stay up to date follow us on social media:

Facebook: @zambiaisback Twitter: @ZambiaIsBack Instagram: zambia_isback

Zambia’s Energy Sector Attractive to Private Investors – Finance Minister

Finance Minister, Dr Situmbeko Musokotwane, has described the country’s energy sector as being attractive for private investment as a result of the ready regional industrial market.

The announcement came at the 58th Annual Meetings of the African Development Bank (AfDB) in Sharm El Sheikh, Egypt.

The event also saw the Zambian delegation in an engagement with Kevin Kariuki, VP for Energy, Climate, and Green Growth at the AfDB.

The minister said, “We discussed energy sector investments and prospects for renewable energy projects. It is gratifying that we have convergent views on Zambia’s energy sector being an attractive proposition for private investment due to the ready regional industrial market.

“We look forward to the Bank playing a more substantive role in regional infrastructure projects, especially in infrastructure development”.

The AfDB has deep roots in Zambia: since 1971 it has committed more than US$1 billion in support of infrastructure, water and sanitation, energy, health, education, transport, and private sector development.

While at the event in Sharm El Sheikh, Dr Musokotwane and his delegation have also met with the Director-General in charge of African affairs at Germany’s Federal Ministry of Economic Cooperation and Development, Birgit Picke.

Picke stressed Germany’s commitment to “continue working with Zambia and helping the country to revive and sustain a robust economy”.

The annual meetings of the AfDB began on Wednesday and end today.

Photo: Lusaka Times

Muscle Maker Inc. Announces Agreement to Purchase Developed Farmland in Zambia for $8.5 Million USD

Muscle Maker, Inc. (NASDAQ:GRIL) ("MMI" or the "Company"), a global agricultural-commodity supply chain and emerging growth stage restaurant company, today announced that its wholly-owned subsidiary, Sadot LLC ("Sadot"), has executed an agreement to purchase approximately 4,942 acres (2000 hectares) of producing agricultural land along with buildings and related assets located within the Mkushi Farm Block of Zambia's Region II agricultural zone (the "Farm"), the country's most productive farmlands, for $8.5 million USD.

Purchase of the Farm is expected to accrue multiple benefits to Sadot as it expands its position as an international agri-foods company. The Farm encompasses developed land that can produce wheat, soy and corn, which are Sadot's main target commodities, along with other high-value tree crops such as Avocado and Mango. In the initial stages, these products will be sold to local African markets with the goal of later integrating into Sadot's international trade, launching a new business vertical in the food supply chain strategy.

"Upon closing of the purchase of the Mkushi Farm, it is expected to continue to diversify MMI's holdings within the world's food and feed supply chain," stated Michael Roper, CEO of MMI. "We view Africa in general and specifically Zambia, as a region that presents numerous opportunities and we expect the purchase to help accelerate Sadot's growth within the agri-commodity space. The addition of Sadot to the MMI portfolio has been the key driver behind our recent growth. We have taken several successful steps in our shift to diversify our U.S.-centric restaurant business towards a more globally focused food organization. The Farm acquisition when closed is expected to further accelerate our growth as a related diversified holding company and to provide MMI shareholders exposure to our enhanced and expanding portfolio."

Sadot entered into a Joint Venture Shareholders Agreement pursuant to which the parties agreed to form a new entity to serve as a joint venture with respect to the operation of the Farm. The joint venture is expected to be named Sadot Enterprises Limited ("Sadot Zambia") with Sadot holding 70% of the equity and other joint venture partners holding 30% of the equity while continuing to operate the Farm.

The purchase is expected to improve access to global credit facilities allowing for larger agri-commodity trades and expanded margin. Previously, Sadot had made a $5 million USD deposit on undeveloped farmland in Africa. That deposit has been applied to this purchase agreement as part of the all-cash transaction. The completion of the acquisition is contingent upon final Zambian governmental approval.

About Muscle Maker, Inc. (MMI)

In late 2022, MMI began its evolution from a consumer-focused, U.S. restaurant business into a global, food-focused organization with two distinct business units:

Sadot LLC

MMI’s largest operating unit is its newly-created subsidiary, Sadot LLC. Sadot is an international agri-foods company engaged in trading and shipping food (and feed) commodities such as soybean meal, wheat and corn. Sadot was formed in partnership with Aggia LLC FZ, a Dubai based, international consulting firm that provides services to companies operating in the global food supply chain.

MMI Restaurant Group

MMI's legacy business is our limited collection of 50+ restaurants, including Pokémoto Hawaiian Poké & Boba Tea and Muscle Maker Grill, and our subscription, fresh-prep meal service, Superfit Foods, with 30+ points of distribution plus in-home and national delivery. All three concepts compete in the growing healthier-for-you segment. National franchise development of the Pokémoto concept is the key growth driver with more than 45 franchise units already in the pipeline.

Forward-Looking Statements

This press release may include "forward-looking statements" pursuant to the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. To the extent that the information presented in this press release discusses financial projections, information, or expectations about our business plans, results of operations, products, or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as "should", "may," "intends," "anticipates," "believes," "estimates," "projects," "forecasts," "expects," "plans," and "proposes." Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. You are urged to carefully review and consider any cautionary statements and other disclosures, including the statements made under the heading "Risk Factors" and elsewhere in documents that we file from time to time with the SEC. Forward-looking statements speak only as of the date of the document in which they are contained, and Muscle Maker, Inc., does not undertake any duty to update any forward-looking statements except as may be required by law.

Investor Relations:

Frank Pogubila

SVP

Integrous Communications

W - 951.946.5288

E - IR@musclemakergrill.com

SOURCE: Muscle Maker, Inc.

The World Is Coming To Zambia

By Albert Halwampa, Director General of the Zambia Development Agency

May has been a milestone month for the Zambia Development Agency.

On May 1, President Hakainde Hichilema officiated at the ground-breaking ceremony for the construction of the United Capital fertiliser plant, a project worth $600 million that was facilitated by the Zambia Development Agency (ZDA). Fittingly, the ceremony took place on International Labour Day. The urea and ammonium plant is just the latest in a series of high-value infrastructure investment partnerships specifically designed to boost the Zambian economy whilst guaranteeing long-term sector sustainability, infrastructural enrichment and stable local employment.

The signing of a memorandum of understanding between the ZDA and Invest Africa on the sidelines of the Africa Debate in London.

On May 4, as Director General of the ZDA, I was delighted to announce a record high projected investment for Q1 of 2023, with investment ventures worth $8.57 billion secured. This represents a nearly 3,500% increase compared to the same period last year. All in all, 81 investment ventures were undertaken in Q1 of 2023, compared to 74 in Q1 of 2022. Not only, therefore, have the overall volume of investments grown but the average financial commitment of each investment has also reached new heights.

As a direct result of these investments, 13,435 new jobs will be sustained. Furthermore, the $8 billion worth of investments earmarked for the energy sector will help fulfil our commitment to Zambia’s energy security and empower Zambians to fulfil their potential in every segment of the economy.

In line with the New Dawn government’s pledge to make Zambia a regional and continental economic powerhouse, we were also pleased to announce that the ZDA has facilitated market access for 20 exporters to potential buyers, and has audited 101 exporters in the Copperbelt, Lusaka and Eastern Provinces.

Further afield, this month I had the pleasure of attending the Africa Debate at the Guildhall in London. With me, alongside a number of other Zambian businesspeople and ministers, was President Hichilema, who in his keynote speech reminded investors that Zambia is “looking for mutually beneficial partnerships”.

President Hichilema at the Zambia Investment Forum, hosted by Invest Africa.

This conference was not only a chance to showcase how far Zambia has come but also an opportunity to further advance our fortunes as a nation. Meetings at the side-lines of the Africa Debate and the Invest Africa Zambia Investment Forum have so far yielded deals with some 162 companies, including a memorandum of understanding with Invest Africa itself to promote foreign direct investment from the UK into Zambia.

I was proud to sign this MoU myself, together with IA chairman and former Africa Minister the Rt Hon. Mark Simmonds. The agreement is yet another indicator of the strong bonds between the ZDA and Invest Africa, as well as Zambia’s longstanding partnership with the UK, and I look forward to welcoming the businesses and financiers that come to Zambia as a result of this close cooperation.

Also agreed within the MoU were provisions to mobilise investments from Europe, the United States of America, the Middle East and Africa, and to continue to hold promotional activities in Zambia and the UK on a reciprocal basis. The sectors likely to benefit the most from our continued partnership with Invest Africa are Agriculture, Energy, Mining and Tourism – all of which are critical to Zambian employment and localised economic enrichment.

Delegates at the business forum in Lusaka, co-hosted by the ZDA and Etion.

On May 18, the ZDA hosted a business forum in partnership with Etion, a business delegation from Belgium in Lusaka. A business-to-business (B2B) meeting was held, along with a networking session, to encourage business linkages and joint ventures between Zambian and Belgian enterprises. So many European investors are excited to deepen ties with Zambian business and industry and I have no doubt that investment summits such as this will continue to enjoy enormous success.

It is a very exciting time to be at the helm of the ZDA, a fantastic moment to be investing in our country, and a proud moment to be Zambian. We look forward to the results of Q2, continue to plan more investment summits, and eagerly anticipate forging new business ties and solidifying those we have already established.

Kenyan retail-tech startup Wasoko expands to Zambia

Kenyan retail-tech startup Wasoko, which leverages innovative technology to transform the informal retail supply chain, has expanded into Zambia, the company’s first location in Southern Africa.

Launched in 2016 as Sokowatch, Wasoko provides free same-day delivery of essential goods and financing to informal retail stores across Africa. The platform enables retailers to order products at any time via SMS or mobile app and receive delivery through its proprietary logistics network to their store.

The startup has delivered over 2.5 million orders to over 50,000 informal retailers across Kenya, Tanzania, Rwanda, Uganda, Ivory Coast, and Senegal, and in March of last year banked a US$125 million Series B round for further expansion.

It has now announced its expansion into Zambia, its first location in Southern Africa. Wasoko will invest over US$1 million in its first year of operations to support local Zambian businesses and communities to get more essential goods for less through the power of e-commerce.

Launching its central hub in Lusaka, Wasoko’s operations will enable small retailers across the city to access an affordable range of products for same-day delivery and working capital financing solely through the convenience of a mobile app. The formation of Lusaka as a central hub is also part of Wasoko’s company-wide pivot to a hub and spoke logistics network to drive stronger operational efficiency and significantly boost its capacity for faster regional expansions.

“As we drive ahead with the next phase of our growth journey, it’s vital that the operating environments of our future markets are conducive to our ambitions and Zambia provides exactly this. With high smartphone usage and a pro-business government administration keen on expanding the country’s digital economy, Zambia is an ideal environment to launch our model and strongly aligns with our current core markets, both in terms of similar regulatory practices and a supplier base which is intertwined with East Africa,” said Daniel Yu, founder and global CEO at Wasoko.

“With this in mind, we’re confident that our new launch will not only play a huge role in accelerating our existing progress across the continent, but also significantly strengthen the purchasing power of everyday citizens in Zambia and enhance their livelihoods in the process.”

In addition to its latest expansion, Wasoko will also be doubling its service radius across all of its existing locations in Kenya, Tanzania, Rwanda and Uganda, where it has amassed a network of over 200,000 informal retailers and delivered more than 5 million orders to date.

Zambia Airways Launches New Direct Flights from Lusaka to Johannesburg

Zambia Airways has announced the launch of new direct flights from Lusaka to Johannesburg, providing passengers with a convenient and reliable way to travel between the two cities. The service will commence operations on 1st June 2023 and will be operated with a modern and comfortable B737-700 aircraft, offering both Business class and Economy class.

The flight schedule has been designed to suit the needs of both business and leisure travelers, with a convenient early morning departure of 07:00hrs from Kenneth Kaunda International Airport in Lusaka. Zambia Airways is committed to providing its passengers with a safe and comfortable flying experience, with all flights operated in accordance with the highest safety standards. The airline’s experienced and friendly cabin crew will provide exceptional service to passengers on board.

“We are delighted to launch our new direct flights from Lusaka to Johannesburg,” said Abiy Asrat Jiru, CEO of Zambia Airways. “This is an exciting development for our airline and demonstrates our commitment to expanding our network and providing our passengers with more travel options within the region.”

With the launch of this new service, Zambia Airways will connect two of the region’s major cities and provide passengers with a convenient and affordable way to travel. The airline is committed to enhancing tourism, attracting investments, and creating job opportunities as the national carrier of Zambia.

Passengers can now book their flights on the Zambia Airways website or contact their local travel agent for more information.

Zambia is Ready for Business, Assures President Hichilema

Last week was a busy week for Zambia’s President Hakainde Hichilema and one that is already being considered a significant milestone in the country’s return to economic stability and prosperity. The President accepted an invitation to attend the coronation of King Charles III on Saturday 6th May and made the most of his trip by pursuing a week of business talks with delegates and investors across the UK and France.

President Hichilema announced on Friday evening that “After a week of over 20 successful meeting and engagements in England, Scotland and France, we have departed from London and are heading back home. We are positive that these engagements will yield positive growth and development for the Zambian people”.

President Hichilema, spotted at Heathrow airport on his way back to Lusaka.

On Tuesday, 9th May, President Hichilema met with the CEO of the UK government’s finance institution, British International Investment (BII), Nick O’Donohue. BII has to date invested more than $100 million in the Zambian economy, especially in the agricultural, energy and economic sectors. President Hichilema assured Mr O’Donohue that the BII’s “investments are safe”, and that Zambia was “looking for mutually beneficial partnerships based on common values and interests for the people of Zambia and the UK”.

On Wednesday, 10th May, President Hichilema held a meeting with Scotland’s First Minister, Humza Yousaf, to strengthen bilateral ties between the nations; HH was delighted to announce that Scotland had committed £1 million to the construction and maintenance of an academic economic research facility in Zambia.

That afternoon, Mr. Hichilema met with Emmanuel Macron, President of France, who sits on the board of the Paris Club of Creditors and the G20 intergovernmental forum. Also present at the meeting were Zambia’s Ministers of Foreign Affairs and International Cooperation, Stanley Kakubo, and of Finance and National Planning, Situmbeko Musokotwane, and some have speculated that some significant trade agreements were tabled at the meeting. All President Hichilema was willing to tell the press was that state debt relief and investment were discussed, and that the meeting was successful.

Presidents Macron and Hichilema before their meeting.

After a number of days of meeting with world leaders, CEOs of global financial institutions and economic experts, President Hichilema headed to the Zambia Investor Forum and Africa Debate in London on Wednesday and Thursday, both organised by Invest Africa, to speak with prospective investors. Mr Hichilema began his keynote speech on Wednesday by reiterating that his government was “committed to reforms – after all, we were elected on a ticket of change, to improve the lives and livelihoods of our people […] through the economy”.

President Hichilema delivering his keynote speech.

President Hichilema said that his government would pursue private sector partnerships to improve the economy and, therefore, the wellbeing of Zambia and its people. He said that the New Dawn government had shown “clear intent” in its meetings with the International Monetary Fund, a major U.S. financial agency and institution which has been pushing for creditors to agree to a framework for Zambia’s debt relief.

Finance Minister Situmbeko Musokotwane urged major investors and economic gurus present at the event to “push for this debt relief to take place”, as Zambia had met all requirements set out in the framework submitted by creditors. Zambian and Western financial figures alike have been frustrated by an apparent reluctance from Chinese creditors to agree to debt relief, though the state visit of President Hichilema and Ministers Musokotwane and Kukubo may prove to be what is needed to move talks forward.

Commerce, Trade and Industry Minister Mulenga announced that the government had set aside 800,000 hectares of land for agricultural development. Zambia enjoyed a record maize harvest last year and will be hoping to shatter that record after receiving assistance from a multi-partner group led by USAID (the United States Agency for International Development) that has put in place the necessary infrastructure to fight against transport issues that have historically contributed to 30% of Zambia’s post-harvest losses. Seven Smart Integrated District Aggregation Centres (SIDAC) have been built to process and store 100,000 metric tons of maize and other grains that would otherwise go to waste. National and international initiatives have also successfully raised awareness about crop diversity in the country, ensuring agricultural stability, sustainability and soil re-enrichment.

Minister Mulenga at the Zambia Investment Forum.

Foreign Affairs Minister Kakubo also reminded investors that Zambia’s vast quantities of minerals “are in the ground, and most of them are not yet explored”. The exploration that has been done shows that Zambia has 6% of the world’s copper reserves and huge deposits of cobalt: two metals that will continue to grow in value as the world transitions to green energy and electrically-powered vehicles.

Zambia is also known for its rich deposits of gold, iron, nickel, manganese and emeralds. The country is the world’s seventh-largest producer of copper, the sixth-largest producer of cobalt, and boasts the largest emerald ever mined. The New Dawn government has recognised the potential for its mineral reserves to transform the nation’s fortunes, making mining one of the primary sectors driving economic growth and benefitting people across the country. Kakubo stressed that he and other senior figures in the mining industry were looking for partnerships to aid exploration into mineral deposits and expansion of the country’s mines. In May 2022, First Quantum Minerals approved plans for a $1.25 billion expansion of the Kansanshi copper mine after “renewed confidence” in Zambia’s economic climate, and other major deals have followed since.

On Thursday, President Hichilema attended Invest Africa’s Africa Debate, an investment summit focused on the African continent whose themes included “the future of African trade, discussing and debating the continent’s trade profile”. Mr. Hichilema gave a keynote speech alongside Andrew Mitchell, the UK Minister of State in the Foreign, Commonwealth & Development Office (FCDO). With a touch of humour, Mr. Hichilema spoke of the importance of education, saying that without the education he had received, instead of being President of Zambia he would “be in the village with 8 or 10 wives”. He reminded the audience that waning diplomacy, the decline of democracy and insufficient protection of human rights were not good for business, highlighting the importance of “peace, security, stability”. He said it was the responsibility of those in power to create a landscape that invited investment and economic growth.

President Hichilema deep in conversation at the Africa Debate.

Karen Taylor, CEO of Invest Africa, who hosted the Investor Forum event, said that “since President Hichilema took office in August ’21, Zambia has undergone a significant shift, change and focus in its economic policies and its approach”. She said that Invest Africa would continue to market Zambia as an investment destination, and that the steps taken by the government had been a significant factor in many organisations’ decision to invest in Zambia. Ms. Taylor applauded the economic reforms the UPND government had made, insisting that this had created an “enabling environment” for foreign direct investment. Mr. Hichilema said after the event that he was “humbled by the huge interest” in Zambia’s economy, and the attendance of “hundreds of key business players from various economic sectors”.

During the Zambia Investor Forum, Zambian Ministers “held a series of meeting with key players in the agriculture, tourism, mining, infrastructure, and energy sectors”, negotiating “investment in our country that will create opportunities and jobs for our citizens,” said Mr. Hichilema. After the event, Mr. Hichilema met with UK Foreign Secretary, James Cleverly, who “expressed how impressed the UK is with Zambia’s development trajectory”, and “reaffirmed the UK government’s support for Africa to have a bigger voice at the G20”. President Hichilema said the meeting was productive, and promised that the government would “continue to encourage joint ventures to ensure that these investments benefit as many of our people as possible”.

President Hichilema with Minister Cleverly at their meeting.

Zambia Investor Briefing: April 2023

OVERVIEW

Mozambique’s President Nyusi played host to his Zambian counterpart Hakainde Hichilema for an official state visit. The aim of the trip was to further cement relations “through increased trade and investment flows” between the two countries, and included a visit to the Port of Beira. A Memorandum of Understanding (MoU) was signed between the neighbours aimed at bolstering collaboration in the area of press standards and freedoms. Issues of peace and security were also central to discussions.

Hichilema travelled to Victoria Falls, Zimbabwe, to take part in the ‘Transform Africa Summit’. The summit brought regional and global leaders together with international organisations from more than 100 countries under the theme ‘Connect, Innovate, Transform’, to collaborate on new ways of shaping, accelerating and sustaining Africa’s on-going digital revolution. Others in attendance included Rwanda’s Paul Kagame, Togo’s Faure Gnassingbé, Malawi’s Lazarus Chakwera and Secretary General of the AfCFTA Wamkele Mene.

A recently published report from Chatham House praised the New Dawn government’s “positive neutrality”, a delicate balancing act which, the report reads, has allowed it to secure investment “from a diverse mix of partners, including Brazil, India, Japan, Saudi Arabia, South Africa, Türkiye and the United Arab Emirates”. It also points to the fact that “Hichilema has resuscitated relations with Western partners, especially the US and UK, and maintained Zambia’s important relationships with China and the African continent”.

Mfikeyi Makayi was appointed CEO of KoBold Metals Zambia. The first female head of a major mining company in Zambia, she will oversee the development of the Mingomba mine in the Copperbelt. Formerly of First Quantum Minerals, Makayi underscored the sector’s importance to Zambia, saying it “is something that will drive our economy into the future”.

A groundbreaking ceremony took place for the construction of a new fertiliser and ammonia plant at the United Capital Fertiliser Zambia Company in Lusaka’s Chilanga district. The USD 600 million project will help bolster the country’s food security, and has come about, according to Hichilema, owing to the “enabling policy and business environment we wanted”.

President Hichilema hosted the Zambian-American business community at the Presidential Luncheon in Lusaka. The event was held under the banner of ‘Zambia’s Economic Revitalisation and Investment Opportunities’, and saw local banks and businesses looking for new investment opportunities in the country.

A statement released by President Hichilema confirmed that the Zambian government were working with “global tech companies” to secure digital literacy training for 10,000 teachers. “Education is the best investment we can make”, he reiterated.

Mozambique State Visit

President Hichilema undertook a three-day official state visit to neighbouring Mozambique, during which a number of important agreements were reached. One such commitment saw the Mozambican government announce plans to resume its supply of electricity to Zambia which, President Nyusi said, was now possible following upgrades to local infrastructure. Zambian Energy Minister Peter Kapala also spoke about plans for new gas and petroleum pipelines running from Mozambique to Zambia.

There were further calls from the Zambian delegation for more cross-border business, particularly in the mining, agriculture and tourism sectors, something President Hichilema was especially keen to see.

On the final day of the visit, the two heads-of-state undertook a visit to the Port of Beira, located in Mozambique’s commercial capital. Whilst there, they attended the Mozambique-Zambia Business Forum, which hosted an event titled “Accelerating Trade and Investment Between Mozambique and Zambia”. The forum was attended by 250 exhibitors representing various sectors from across the business community.

Transform Africa IT Summit

Six presidents were in attendance at the three-day summit, which took place in Victoria Falls, Zimbabwe, and saw the launch of the African Development and Smart Africa Alliance. The USD 1.5 million agreement is designed to enhance digital trade and e-commerce ecosystems across Africa.

The alliance will streamline e-payment policies across ten countries - Côte d’Ivoire, Benin, Ghana, Uganda, South Sudan, Zimbabwe, Republic of Congo, DR Congo, and Sao Tomé and Principe.

Hichilema gave an address at the summit, in which he implored nations to embrace new technologies “with the aim of increasing productivity and creating more jobs, particularly for our young people [on] the continent”.

“Harmonising our legislation and technological platforms in Africa is also crucial to facilitate market sharing and the movement of people and goods, while maintaining security”, he wrote in a statement. “Harmonised digital platforms will also make it easier for joint public-private ventures among our citizens to do business”.

Currency

1 USD = 17.86 ZMW 30 day average = 19.171 Volatility (last 30 days) = 1.3%

OTHER NEWS

Zambia reaps rewards of positive neutrality and economic diplomacy while others flounder, 02.04.23, Daily Maverick

China's loans to Africa worry World Bank President David Malpass, 02.04.23, BBC New

Zambia mining sector gets first female chief executive, 06.04.23, BBC News

Yellen to push for ‘speedy’ action on Zambia, Ghana debt relief, 11.04.23, Al Jazeera

Zambia sees scope for $12.8 billion debt-revamp deal next week, 12.04.23, Bloomberg

Zambia: UN experts concerned over delay in the country’s debt restructuring, 17.04.23, United Nations

Moxico provincial government to boost cooperation with Zambia, Angop, 24.04.23

Zambia has sent debt restructuring proposal to official creditors, Reuters, 24.04.23

UPCOMING EVENTS

10.05.23

London, UK

11.05.23

The Africa Debate: Catalysing the Continent’s Trade Potential

London,UK

14.05.23 - 16.05.23

Africa Trade and Investment Global Summit

Dubai, UAE

CONTACT US

If you would like to find out more or receive tailored briefings on specific sectors get in touch via info@zambiaisback.com. To stay up to date follow us on social media:

Facebook: @zambiaisback

Twitter: @ZambiaIsBack

Instagram: zambia_isback

Zambia’s GDP to Grow by 4.2% in 2023

Secretary to the Treasury, Felix Nkulukusa, announced yesterday that Zambia’s economy is projected to expand by 4.2% in 2023.

This will be a slight dip compared to last year’s growth of 4.7%, which is to be expected following the months of wrangling over the country’s debt restructuring. However, the Secretary was optimistic about the news, as GDP forecasts 4.8% and 4.7% growth in 2024 and 2025 respectively.

This is very welcome news. Zambia was the first major country to default on its $18 billion foreign debt during the Covid pandemic in 2020. The following years has seen issues with its creditors, who had for some time struggled to make headway with debt restructuring plans.

Zambia’s external debt is split roughly three ways: one third is owed to Chinese lenders, another to private creditors, and the rest to other governments and multilateral lenders, such the World Bank and International Monetary Fund (IMF).

Nkulukusa said central government external debt had increased by 1% to $14.09 billion as of end of this March from $13.96 billion at the end of 2022, making Zambian public debt a total of $25.4 billion.

He said in his announcement, “the increase in debt stock was largely on account of disbursements received from multilateral creditors for budget support and project loans”.

Photo: @CUTS_Lusaka / Twitter

President Hichilema to Speak at The Africa Debate, London

President Hakainde Hichilema is due to deliver a speech at The Africa Debate, London’s leading investment summit focused on Africa. The event – this year being its ninth iteration – will be held on 11 May at the Guildhall under the theme “Catalysing the Continent’s Trade Potential”.

Attendees at this year’s Africa Debate will span continents and industries. Among the guest list are representatives of investment firms, heads of global businesses, and policy and change makers from across the globe, including Africa, Europe, North America, and the Middle East.

The President is set to be the focus of the “Country Spotlight” event, where he will be interviewed about Zambia’s growing trade potential. Other events in the programme include interviews with Wamkele Mene, Secretary General of the African Continental Free Trade Area, and Samaila Zubairu, President and CEO of the Africa Finance Corporation, as well as speeches from British politicians Mark Simmonds and Andrew Mitchell.

Delegates at The Africa Debate, 2022. Photo: Fiona Hanson

There will also be various debates held throughout the day. A panel will discuss “Building a Comprehensive Digital Trade Strategy for Africa”, which will explore innovation in digital strategy and e-commerce across the continent. Other topics set to be explored through debates and panel discussions include: boosting the industrialisation of African countries; ESG regulatory initiatives in African trade; leveraging the continent’s critical minerals supply; and strengthening Africa’s finance sector.

The Africa Debate is organised and hosted by Invest Africa, the UK’s leading trade and investment platform for African markets. Invest Africa describes the continent’s trade outlook as “at a crossroads”. On the one hand, it is suffering from global supply chain disruptions following the Covid pandemic and the Russian invasion of Ukraine which “paint[s] a gloomy picture” of the future of Africa’s trade, as well as the threat of debt risks. But on the other hand, African trade and investment is aligning under the recently established African Continental Free Trade Area (AfCFTA), which aims to strengthen and protect it.

It is hoped that The Africa Debate in May will provide a forum for leaders in industry to discuss, and prepare for, the future of African trade. There is still time to register for a place at the summit.

Minister: Northern Province Embracing Digital Innovation

Northern Province will welcome investment in digital technology in order to unlock the social and economic potential of the region, Northern Province Minister Leonard Mbao has said. The announcement came during a business forum he was officiating in Kasama, organised by MTN Zambia, the country’s leading telecommunications provider. It is hoped such a move will innovate the region’s tourism sector and mining industry.

Mbao told the business forum, “This government is committed to delivering inclusive and equitable development to the citizens. Therefore, digitalisation is a catalyst in the provision of inclusive development and as a government we welcome MTN’s innovation in coming up with digitalised services and products for its clientele. The government is convinced that this kind of digital innovation and forum is the sure way of unlocking the development potential of the province.”

The government’s Constituency Development Fund (CDF), originally introduced in 1995 as a means of encouraging local development in communities across the country, is important in the development of these digital services. The CDF, along with the government’s decentralisation of local policy, can enable local governments to partner with service providers in developing connection and innovation in the region.

The Minister noted the growth of mobile network and digital financial services in Zambia. This was emphasised by MTN’s General Manager North, Elias Chembe, who revealed the company has built 82 4G towers in the region and has plans for the erection of many more, of which 11 will be in the Northern Province.

Chembe said, “In line with the government’s decentralised policy where each constituency is given its share of the national cake, market loans given to our marketers, social cash transfer given to the intended beneficiaries, MTN mobile money services provide the needed support that the government needs to execute its mandate in these areas.”

He stressed MTN’s aim for more regional investment and collaboration with local government, traditional leaders, and Zambian businesses.

Huawei Hosts Zambia’s First Telecom Congress

Zambia’s first ever Telecom Congress took place over the course of two days last week. The event was hosted by Chinese information and communications technology (ICT) company, Huawei, at the Lusaka International Convention Centre (LICC). Huawei, as a global provider of ICT infrastructure and smart devices, has been operating in Zambia for the last 18 years.

The inaugural congress was themed ‘Lighting up ICT for Zambia Digital Life’, and brought together government officials and heads of industry to discuss the present state of the nation’s ICT sector and ideas for its future. Its aim was to explore the various opportunities among government and private corporations to support Zambia in meeting its growing technological demands.

It was at this congress that the Technology and Science Minister, Felix Mutati has announced there has been a 300% growth in mobile money transactions in Zambia in the period from 2021 to 2022. Mutati’s disclosure that K300 billion was transacted via mobile networks last year is the latest in a series of welcome developments concerning progress made in the country’s financial technology sector.

Mutati, in his comments about the recent growth of mobile money transactions, pointed to the work done by new technologies – such as 5G – in increasing ICT usage in Zambia. But he stressed that the country cannot go digital without good connectivity. To this end, the government are planning to erect an additional 300 phone towers in an effort to increase accessible and affordable networks – even in rural areas.

The minister did note, however, that “the old model of erecting towers must be revisited”. He pointed towards technology providers being responsible for providing cheaper options, saying, “we also need appropriate financing to make connectivity faster”.

Huawei’s leading representative at the Congress, its Vice President for Carrier Business Chen Li, reiterated the company’s commitment to aiding Zambia achieve this technologically connected future. Its ability to provide 2G, 3G, 4G, and 5G services means there are cost effective solutions to provided connectivity in rural areas. Doing so, according to Li, would mean “enabling more people to connect to the world.”